2025 Analysis

| Assessment: PRC-Lead | Confidence Interval: High |

| Direction: Trend Contested | Confidence Interval: Low |

________

China Dominates Battery Production as the United States Aims to Close the Gap

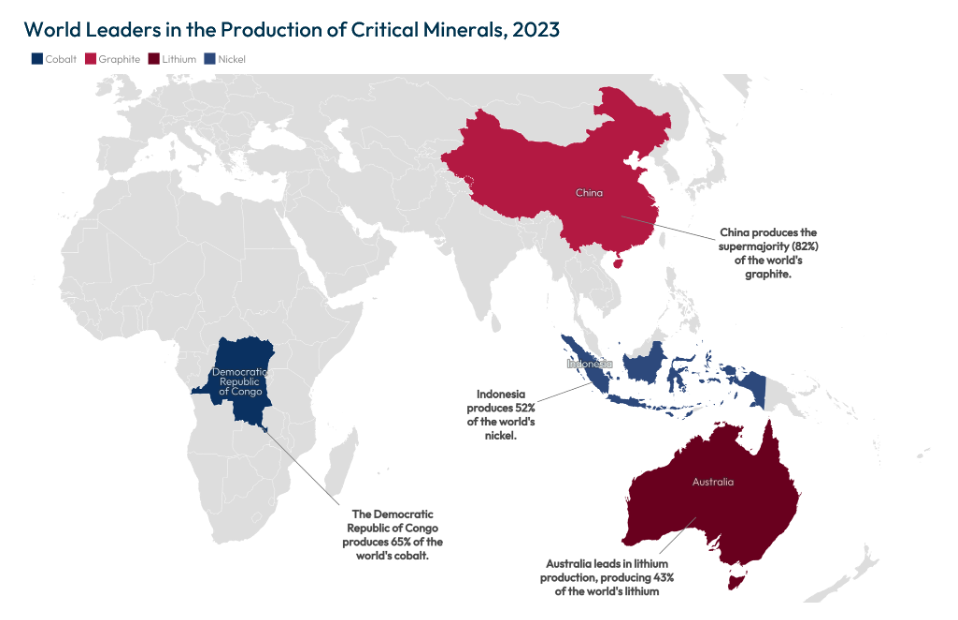

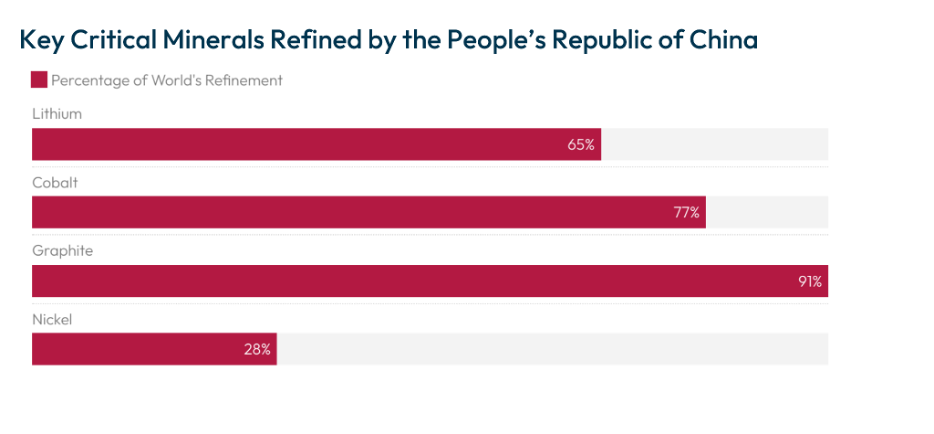

Over the past three years, China’s control over the advanced battery market has continued to strengthen, solidifying its position as a global leader in the field. The root of China’s dominance in the advanced battery sector stems from its control over the critical minerals supply chain and its impressive battery production capacity, which both rely heavily on the nation’s industrial manufacturing base and infrastructure-first industrial policies. Despite the geographical distribution of critical mineral production across several countries, China has strategically focused on refining minerals such as lithium and graphite, crucial raw materials in the battery manufacturing process.[1] China’s dominance in these areas has allowed it to maintain a firm grip on the downstream battery supply chain, including electric vehicles (EVs) and a range of other battery-dependence platforms such as commercial drones, underscoring the strategic role critical materials play in the global supply chain.[2]

Source: Global Critical Minerals Outlook 2024, International Energy Agency (2024).

Source: Global Critical Minerals Outlook 2024, International Energy Agency (2024).

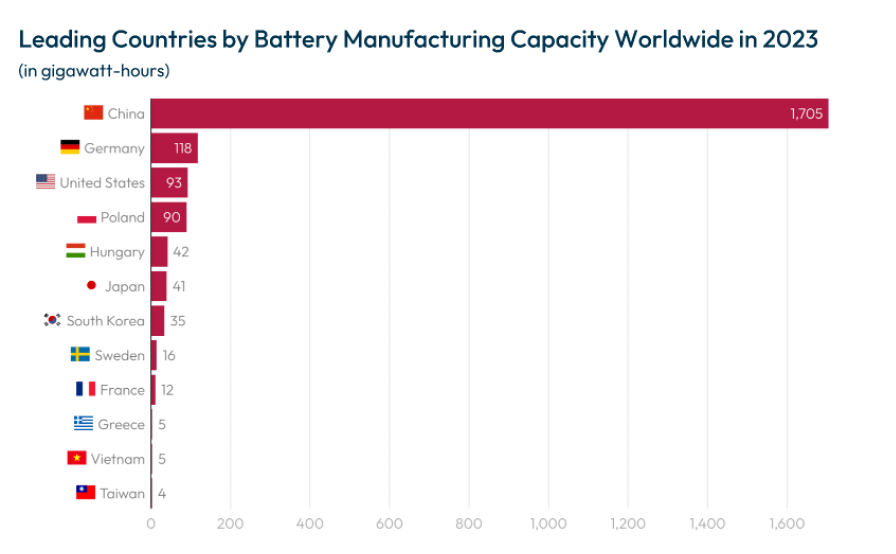

Beyond critical mineral mining and processing, China’s battery manufacturing capacity also remains unmatched globally, producing a staggering 1,705 gigawatt-hours (GWh), dwarfing the United States’ 93 GWh in 2023.[3] This disparity is particularly evident in the lithium-ion segment of the sector, where China commanded 80% of the world’s shipments of lithium-ion battery components in 2023,[4] accounting for approximately 60% of the global EV battery market.[5] PRC companies, led by giants like CATL and BYD, maintain their grip on the EV landscape, collectively accounting for over 50% of global market share.[6] Notably, no U.S.-based companies are among the top ten global EV battery makers.

Source: Leading Countries by Battery Manufacturing Capacity Worldwide in 2023, Statista (2024).

To bolster domestic advanced battery innovation and manufacturing, the United States has undertaken significant policy actions in the past two years, to include landmark pieces of bipartisan legislation like the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA). The BIL allocated over $3 billion to support 25 projects across 14 states for domestic battery production.[7] Furthermore, the IRA included measures designed to incentivize consumers to purchase EVs with batteries made in the United States and provided tax credits to manufacturers to build new battery facilities.[8] As a result of these initiatives, the number of battery facilities in the United States has increased from two in 2019 to more than 34 in 2024.[9] Over the past two years, U.S. investments — both public and private — in batteries and critical minerals refining has grown at least threefold, with battery manufacturing investments totaling nearly $43 billion from 2023 to 2024.[10] Overseas, the United States is working to strengthen the battery supply chain alongside allies and partners through recent initiatives such as the Minerals Security Partnership (MSP) and the Indo-Pacific Economic Framework for Prosperity (IPEF).[11] These initiatives aim to bolster the battery supply chain by promoting responsible sourcing and investment in critical minerals among members. Continued prioritization of and investment into the United States’ battery industry will be critical to reduce dependence on China.

Wildcards

- Are Tariffs and Other Market Restrictions on PRC EVs Too Little Too Late? Washington is implementing measures to prevent PRC-made EVs from flooding the U.S. market — including 100% tariffs and restrictions on PRC-origin interconnected vehicle hardware and software.[12] U.S. allies are taking similar actions. The EU imposed a lower, provisional anti-subsidy tariff of 45.3%, while Canada increased its 6.1% import tariff on Chinese EVs to 100%.[13] But these tariffs differ in aim: the United States views tariffs as one element of a larger strategic toolkit to reduce dependency and bolster domestic capabilities, whereas the EU is using them as a targeted, rules-based mechanism to correct identified market distortions.[14] In response, China has both retaliated and adapted, exporting more hybrid vehicles and shifting some assembly to Europe to mitigate tariff impacts. Whether these measures effectively reduce reliance on China’s entrenched EV supply chain — and at what cost — remains uncertain.[15]

- Will PRC Battery Overcapacity Distort Global Markets? While China’s dominant position in battery production is impressive, it’s accompanied by the prospect of significant overcapacity as the world transitions from internal combustion engines (ICE) to electric vehicles. EVs are by and large driving the demand for today’s advanced batteries. In 2023, China utilized less than 40% of its maximum cell output, and the country’s installed manufacturing capacity for cathode and anode active materials far exceeded global EV cell demand.[16] To alleviate this excess, China has become the world’s largest exporter of EV cells, cathodes, and anodes, and CATL — China’s largest battery manufacturer — is considering pulling back on lithium production, demonstrating some of the early signs of oversupply amid weak demand.[17]

What to Watch

- AI Innovations Likely to Yield New Advanced Materials and Battery Chemistries. AI innovations in battery-related R&D could transform the energy storage sector and will be the lynchpin for the United States and its allies and partners to regain an upper hand in the sector. AI has already accelerated the search for novel battery chemicals, narrowing 32.6 million possibilities to 18 promising candidates in under a week — a task that would otherwise have taken 20 years.[18] Deep learning AI models and programs like the Materials Genome Initiative are unlocking thousands of new materials for future technologies, like the next generation of long-duration energy storage.[19]

- New Models of Public-Private Partnerships Could Supercharge Battery R&D. New public-private partnerships in this space are also showing some promise: an AI-focused partnership between the U.S. government and industry early this year led to the discovery of a new kind of solid-state electrolyte that could cut down the amount of lithium used in a battery by as much as 70 percent.[20] However, the PRC has demonstrated an ability to rapidly move novel battery chemistries into mass production.[21] Additional progress in synthesizing AI-designed materials and scaling production for novel battery chemistries will be critical for the United States to catch up.

[1] Outlook for Key Minerals, International Energy Agency (2024).

[2] Jon Emont, China Harnesses a Technology That Vexed the West: Unlocking a Treasure Chest, Wall Street Journal (2024).

[3] Leading Countries by Battery Manufacturing Capacity Worldwide in 2023, Statista (2023).

[4] China’s Market Share in Key EV Battery Components Tops 80%, Nikkei Asia (2024).

[5] China Already Makes as Many Batteries as the Entire World Wants, Bloomberg (2024).

[6] Lei Kang, Global EV battery market share in 2023: CATL 36.8%, BYD 15.8%, CNEV Post (2024).

[7] Biden-Harris Administration Announces Over $3 Billion to Support America’s Battery Manufacturing Sector, Create Over 12,000 Jobs, and Enhance National Security, U.S. Department of Energy (2024); Battery Materials Processing Grants, U.S. Department of Energy (2024).

[8] Owen Minott & Helen Nguyen, IRA EV Tax Credits: Requirements for Domestic Manufacturing, Bipartisan Policy Center (2023).

[9] Tracking the EV Battery Factory Construction Boom Across North America, TechCrunch (2024).

[10] Lily Bermel, et al., Clean Investment Monitor: Tallying the Two-Year Impact of the Inflation Reduction Act, Rhodium Group (2024).

[11] Joint Statement on the High-Level Minerals Security Partnership Forum Event in New York City, U.S. Department of State (2024); Indo-Pacific Economic Framework for Prosperity, U.S. Department of Commerce (last accessed 2024).

[12] USTR Finalizes Action on China Tariffs Following Statutory Four-Year Review, Office of the U.S. Trade Representative (2024); David Sanger, et al., Biden Administration Proposes Ban on Chinese Software in Vehicles, New York Times (2024).

[13] EU, China Close to Agreement over EV Import Tariffs, Leading MEP Says, Reuters (2024); João da Silva, Canada Hits China-made Electric Cars with 100% Tariff, BBC (2024).

[14] Francesca Ghiretti, Not All Tariffs Are the Same: The Core Differences between U.S. and EU Tariffs against Chinese EVs, Center for Strategic and International Studies (2024).

[15] Melissa Eddy & Jenny Gross, Europe Imposes Higher Tariffs on Electric Vehicles Made in China, New York Times (2024).

[16] Outlook for Battery and Energy Demand, International Energy Agency (2024); Trends in Electric Vehicle Batteries, International Energy Agency (2024).

[17] Sherry Qin, Lithium Miners Shares Surge on Possible CATL Supply Cut, Wall Street Journal (2024).

[18] Accelerating the Discovery of Battery Materials with AI, Science (2024); Casey Crownhart, How AI Could Supercharge Battery Research, MIT Technology Review (2023).

[19] See for example, Jonathan Godwin, Introducing ‘Orb’ – The World’s Fastest and Most Accurate AI Model for Simulating Advanced Materials, Orbital (2024); About the Materials Genome Initiative, Materials Genome Initiative (last accessed 2024); Amil Merchant & Ekin Dogus Cubuk, Millions of New Materials Discovered with Deep Learning, Google DeepMind (2023).

[20] Mark Johnson, New Battery Material that Uses Less Lithium Found in AI-Powered Search, Wall Street Journal (2024).

[21] Edward White, et al., Can Anyone Challenge China’s EV Battery Dominance?, Financial Times (2023).