2025 Analysis

| Assessment: PRC-Lead | Confidence Interval: High |

| Direction: PRC | Confidence Interval: Medium |

________

China Supercharging Manufacturing Industrial Base, United States Looks for Leapfrogs

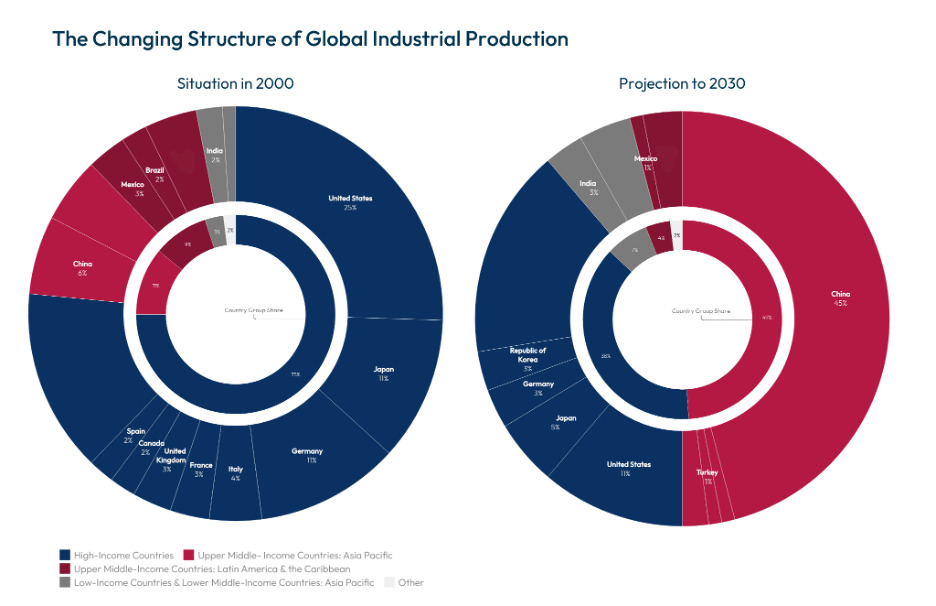

China leads the world in terms of manufacturing capacity and is responsible for nearly 35% of gross global output, followed by the United States at around 12%, with Japan, Germany, and South Korea following closely behind.[1] In recent years, the PRC government has identified advanced manufacturing as the primary basis of China’s economic power, with PRC net lending to the sector rising from just $63 billion in 2019 to over $680 billion in the first three quarters of 2023.[2] Guided by a number of national strategies, China has established leadership positions across a range of advanced industries, from batteries to solar cells, electric vehicles, and legacy chips, and leads the world in terms of robotics deployment.[3] In 2023, PRC firms deployed as many industrial robots as the rest of the world combined.[4] These factors position China to capitalize on trends in automation and cement its position as the world’s sole advanced manufacturing superpower into the decade.

Source: The Future of Industrialization, United Nations Industrial Development Organization at 17 (2024).

Despite China’s status as an industrial powerhouse, various metrics suggest that, at the technology layer, advanced manufacturing remains a contested battleground. U.S. companies have a significant lead in generative AI, which is driving innovation across a range of advanced manufacturing activities.[5] More broadly, U.S. firms are pioneering novel manufacturing techniques and software-defined manufacturing paradigms which, if widely adopted across the U.S. industrial base, could offset PRC advantages.[6] Like the United States, China has experienced challenges in encouraging domestic manufacturing firms to adopt advanced manufacturing technologies: according to PRC state-affiliated sources, as of 2022, only 37% of manufacturers in China had reached a basic level of digitalization and industrial intelligence, while only 4% of PRC manufacturers had attained leading-edge capabilities.[7]

Wildcards

- Will Humanoid Robot Adoption Take Off? The widespread deployment of humanoid robots may materialize within the next decade, driven by advances in generative AI and significant venture capital investments. With manufacturing costs declining rapidly, robotic labor could become economically competitive with human labor. Yet critical barriers remain, including reliability and safety issues, perfection of training methods based on limited data, and cultural resistance to automation in the United States. China holds a significant manufacturing advantage, with domestic firms producing robots that are 80% as capable but 30% cheaper than U.S. models, backed by massive state investments.[8]

- Will U.S. Cultural and Political Attitudes Stymie Robotics Deployment? Recent strikes at U.S. ports demonstrate that some unions increasingly view automation with increasing suspicion.[9] Based on recent polling, citizens in the United States and other western countries tend to have more negative outlooks on the effects of automation than Asian countries.[10] The extent to which these differences in cultural attitudes shape the U.S. robotics deployment landscape has yet to be determined. However, they could significantly impact U.S. manufacturing competitiveness in the near future.

- Will China Escalate the Use of Retaliatory Measures to Undermine U.S. Efforts at Reindustrialization? Given its virtual monopoly on a range of advanced technology inputs, such as rare earth minerals mining and processing, China has significant geoeconomic leverage.[11] This leverage could be wielded to counter U.S. export control and investment screening measures. Indeed in December, Beijing imposed export restrictions on four critical minerals to the United States, a marked escalation in its retaliatory responses to U.S. policy actions.[12]

What to Watch

- Will China Dominate the Robotics Hardware Stack? China has long been a robotics importer, but PRC firms met over half of domestic demand for the first time last year.[13] Recent policy guidance[14] from Beijing seeks to establish China as the global manufacturing hub for humanoid robotics by 2027.[15] PRC firms already dominate downstream supply chain inputs, such as batteries, electric motors, and raw materials.[16]

- Will U.S. Policy Continue to Emphasize Reindustrialization? The Biden Administration worked with Congress to pass massive investments in advanced manufacturing industries, including EVs, energy storage, and semiconductors.[17] The incoming administration will likely continue to advance these efforts, while also using tools like tariffs to achieve industrial policy goals.[18] Efforts to rebuild U.S. manufacturing may come down to tax policy: extending expensing provisions for capital equipment from the 2017 Tax Cuts and Jobs Act would help drive robotics deployment.

- Will China’s Trading Partners Accept a China Shock 2.0? PRC policymakers have identified advanced manufacturing industries, so-called “new quality productive forces,” or sectors such as renewable energy technology and electric vehicles, as the basis of the PRC’s economic growth into the near future.[19] As fears of China’s industrial overcapacity mount, growing trade restrictions could reduce China’s ability to export its way out of its economic slowdown.

[1] Richard Baldwin, China is the World’s Sole Manufacturing Superpower: A Line Sketch of the Rise, Centre for Economic Policy Research (2024).

[2] Keith Bradsher, More Semiconductors, Less Housing: China’s New Economic Plan, New York Times (2023).

[3] Alexander Brown et al., Robotics Sector + “Complete Industrial Chain” + Industrial Internet, Mercator Institute for China Studies (2023).

[4] Record of 4 Million Robots in Factories Worldwide, International Federation for Robotics (2024).

[5] Jacob Achenbach, et al., Harnessing Generative AI in Manufacturing and Supply Chains, McKinsey (2024).

[6] Action Plan for United States Leadership in Advanced Manufacturing, Special Competitive Studies Project at 15 (2024).

[7] China Electronics Technology Standardization Institute (中国电子技术标准化研究院), Intelligent Manufacturing Maturity Index Report (智能制造成熟度指数报告), (2023).

[8] Robert D. Atkinson, How Innovative Is China in the Robotics Industry?, Information Technology & Innovation Foundation (2024).

[9] Heather Long, The Real Reason 47,000 Dockworkers Are On Strike, The Washington Post (2024).

[10] Courtney Johnson & Alec Tyson, People Globally Offer Mixed Views of the Impact of Artificial Intelligence, Job Automation On Society, Pew Research Center (2020).

[11] Gracelin Baskaran, What China’s Ban on Rare Earths Processing Technology Exports Means, Center for Strategic and International Studies (2024).

[12] Keith Bradsher, China’s Critical Minerals Embargo Is Even Tougher Than Expected, New York Times (2024).

[13] Will the United States or China Lead in Humanoid Robotics?, Special Competitive Studies Project (2024); Jacky Wong, China Needs More Factory Robots. Can It Build Its Own?, Wall Street Journal (2024).

[14] Guiding Opinions on the Innovation and Development of Humanoid Robots” Was Issued: Reaching the World’s Advanced Level by 2027, Ministry of Industry and Information Technology (2023).

[15] Will the United States or China Lead in Humanoid Robotics?, Special Competitive Studies Project (2024).

[16] Jacqueline Du, et al., Humanoid Robot: The AI Accelerant, Goldman Sachs (2024).

[17] Heather Boushey, The Biden-Harris Administration Has Catalyzed $1 Trillion in New U.S. Private Sector Clean Energy, Semiconductor, and Other Advanced Manufacturing Investment, The White House (2024).

[18] Dylan Butts, Trump Likely to Uphold CHIPS Act Despite His Campaign Rhetoric, Policy Experts Say, CNBS (2024).

[19] Arthur R. Kroeber, Unleashing “New Quality Productive Forces”: China’s Strategy for Technology-led Growth, Brookings Institution (2024).