2025 Analysis

| Assessment: Contested | Confidence Interval: Moderate |

| Direction: Contested | Confidence Interval: Moderate |

________

The U.S. Lead in Biopharmaceuticals Continues to Face Rising Competition from China

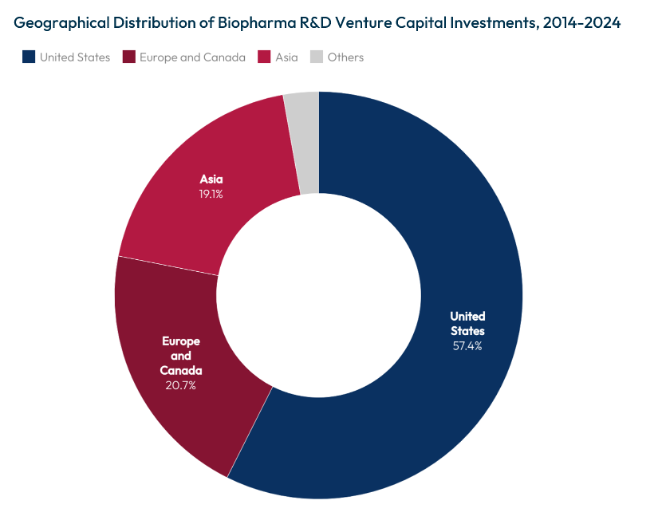

The United States continues to lead in the initial stages of the biopharmaceutical value chain, supported by a regulatory environment that avoids government price controls, ensures strong intellectual property protections, and benefits from substantial public investment in research. National Institutes of Health (NIH) funding remains robust, averaging around $48 billion annually,[1] with roughly 83% supporting extramural research via nearly 50,000 competitive grants awarded to more than 300,000 researchers nationwide.[2] As a result, U.S. biotechnology firms command significant early-stage capital, attracting about $57 billion in 2023[3] — representing 35% of global biotechnology investment.

Source: Biopharmaceutical Pipeline Funded by Venture Capital Firms, 2014 to 2024, Health Affairs Scholar (2024).

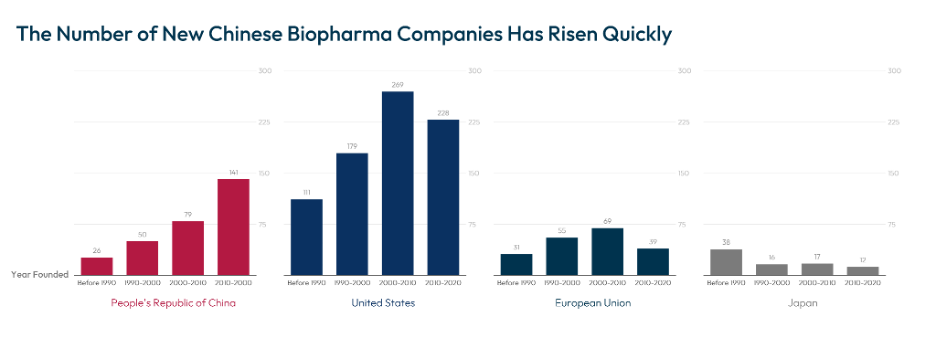

Meanwhile, China’s “14th Five-Year Plan for the Development of the Pharmaceuticals Industry”[4] marks a notable pivot from merely adopting foreign innovations to actively pioneering them.[5] The National Natural Science Foundation of China (NNSF), its largest public science funder, expanded basic research and frontier exploration funding to nearly $5.2 billion[6] across 51,600 grants in 2022.[7] In the private sector, PRC firms secured about $21 billion in biotechnology investments in 2023 (12.7% of the global total).[8] These efforts have rapidly borne fruit, evident in the surge of China’s global biopharmaceutical innovation share from 4.1% to 13.9% by 2020[9] and its rising slice of global biotechnology patents, now reaching 10%.[10] The United States still maintains a leading position, holding 39% of global biotechnology patents in 2020.[11]

Source: John Wong, et al., Competing in China’s Biopharma Market: Key Success Factors for Multinational Companies, BCG (2020).

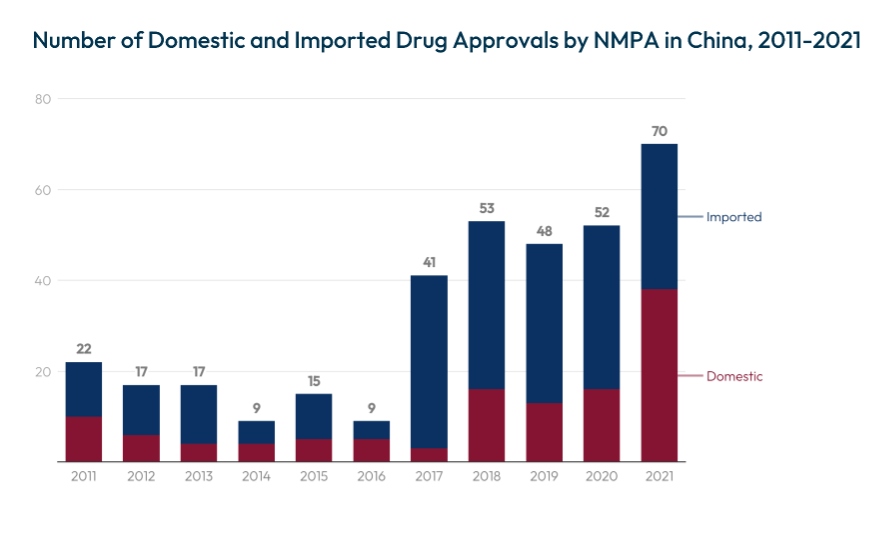

A critical indicator of innovation leadership is the ability to bring novel drugs to market. Between the periods of 2000-2008 and 2009-2017, U.S. Food and Drug Administration (FDA) approvals rose by 44.5%.[12] By 2023, the FDA approved 55 new drugs,[13] including three from PRC developers.[14] In parallel, China’s National Medical Products Administration (NMPA) approved 87 novel drugs in 2023, including five first-in-class drugs from domestic firms.[15] These outcomes highlight how China’s regulatory reforms[16] have reduced approval backlogs and increased both imported and domestically developed medicines since 2011,[17] underscoring its growing ability to transform discoveries into marketable products.

Source: How Innovative Is China in Biotechnology?, Information Technology & Innovation Foundation (2024).

Where the United States struggles to compete with China in biopharmaceuticals is, like in many other sectors, on the commercialization and production side of the value chain. Supply chain, regulatory, and production capacity factors have improved China’s relative position. While the United States still led in 2020 with 28.4% of global pharmaceutical production (up from 26.2%in 1995), China’s share climbed to 17.4% during the same period, a dramatic increase of 14.4%.[18] This shift is evident in trade patterns: in 2022, U.S. biopharmaceutical imports from China totaled $10.2 billion, outpacing exports of $9.3 billion.[19] Moreover, PRC firms now supply about 17% of U.S. Active Pharmaceutical Ingredients (APIs),[20] at a time when only 28% of API manufacturers are based in the United States.[21] Reflecting these dependencies, the U.S. biopharmaceutical trade deficit with China grew from $959 million in 2010 to $4.07 billion by 2022.[22]

Source: Not Again: Why the United States Can’t Afford to Lose Its Biopharma Industry, Information Technology & Innovation Foundation (2024).

In response, U.S. policymakers have designated pharmaceuticals as a critical supply chain priority, committing $40 million to domestic biomanufacturing[23] and an additional $35 million under the Defense Production Act for essential medicines.[24] Although the United States remains a leader in innovation, China’s role as a critical supply chain link — reflected in growing U.S. reliance on PRC-origin APIs and widening trade deficits — shows that competition has evolved beyond innovation to encompass the entire pharmaceutical value chain.

Wildcards

- Could the United States Alter the Biopharma Landscape and Limit Business with PRC Biotechnology Firms? U.S. policymakers have proposed limiting federal contractors from working with certain PRC biotechnology firms.[25] Though such limitations could initially increase costs and disrupt production, it could strengthen U.S. supply chain security over the longer term.[26] With 79% of U.S. biotechnology firms holding contracts with PRC partners,[27] there is a clear need for diversification. India stands out as a strong alternative given its API production and contract manufacturing expertise,[28] while Japan[29] and South Korea[30] also offer reliable options. These moves could reduce geopolitical risks and improve the U.S. biopharma sector’s long-term resilience.

- Could China Retaliate Against U.S. Biopharma Firms? Recognizing the difficulty of immediate derisking, policy proposals to limit business with PRC biotechnology firms, such as the BIOSECURE Act, would allow existing contracts with PRC suppliers to continue until 2032.[31] Enactment of such a proposal could push China to respond aggressively. The PRC’s recent restrictions on critical minerals show a willingness to use economic leverage in retaliation.[32] If China were to apply similar tactics to biopharma supplies, U.S. companies might have to accelerate supply chain shifts, incurring high costs and widespread disruption. This highlights the importance of early planning and broader supplier networks.

What to Watch

- Biomanufacturing Automation Could Eliminate China’s Cost Advantage in Production. Advanced manufacturing technologies like continuous bioprocessing[33] and automated quality control systems[34] could change cost equations in biopharmaceutical production. However, the impact will depend on adoption rates and whether automation can truly offset other cost factors. If widely adopted, these innovations could weaken the cost advantage currently held by PRC manufacturers.

- AI Tools Could Radically Accelerate Drug Development Timelines. AI tools are increasingly being deployed across the drug development pipeline,[35] from target identification to clinical trial optimization. This includes advancements in AI-powered simulations, like those being developed in self-driving labs, which can predict the behavior of molecules and accelerate the design process.[36] Both U.S. and PRC companies are making significant investments in AI-enabled drug discovery platforms: as of the first quarter of 2023, 78% of the top 50 investors in AI for drug discovery were based in the United States, with China accounting for around 12%.[37] The technology’s actual impact on development timelines and success rates[38] will be a key metric for assessing future competitive advantages in biopharmaceutical innovation.

- Localized Bioproduction Could Reduce Dependence on Centralized Global Supply Chains. Decentralized bioproduction technologies, such as modular biologics manufacturing platforms[39] and single-use bioreactors,[40] could revolutionize the pharmaceutical supply chain by enabling local production. These systems reduce dependency on large, centralized facilities, potentially lessening reliance on China for cost-effective manufacturing. Early adopters of these models may gain a significant edge, especially in responding to global health emergencies or regional shortages.[41] Tracking developments in this space will highlight the players reshaping biopharma production logistics.

[1] National Institutes of Health (NIH) Funding: FY1996-FY2025, Congressional Research Service (2024).

[2] Budget, National Institutes of Health (last accessed 2024).

[3] Brian Buntz, The Global Biotech Funding Landscape in 2023: U.S. Leads While Europe and China Make Strides, Drug Discovery & Development (2024).

[4] Issuance of the 14th Five-Year Plan for National Drug Safety and High-Quality Development, National Medical Products Administration (2021).

[5] Sandra Barbosu, How Innovative Is China in Biotechnology?, Information Technology and Innovation Foundation (2024).

[6] China’s Science Foundation Ups Research Budget to 33B Yuan, The State Council of the People’s Republic of China (2022).

[7] 2022 Annual Report, National Natural Science Foundation of China (2022).

[8] Brian Buntz, The Global Biotech Funding Landscape in 2023: U.S. Leads While Europe and China Make Strides, Drug Discovery & Development (2024).

[9] Sujai Shivakumar, et al., Understanding the U.S. Biopharmaceutical Innovation Ecosystem, Center for Strategic and International Studies (2024).

[10] The Global Landscape of Biotech Innovation: State of Play, EU Science Hub (2024).

[11] The Global Landscape of Biotech Innovation: State of Play, EU Science Hub (2024).

[12] Angelika Batta, et al., Trends in FDA Drug Approvals Over Last 2 Decades: An Observational Study, National Library of Medicine (2020).

[13] Novel Drug Approvals for 2023, U.S. Food & Drug Administration (2023).

[14] Lang Zheng, et al., Targeted Drug Approvals in 2023: Breakthroughs by the FDA and NMPA, Signal Transduction and Targeted Therapy (2024).

[15] Lang Zheng, et al., Targeted Drug Approvals in 2023: Breakthroughs by the FDA and NMPA, Signal Transduction and Targeted Therapy (2024).

[16] Lili Xu, et al., Reforming China’s Drug Regulatory System, Nature (2018).

[17] Ling Su, et al., Trends and Characteristics of New Drug Approvals in China, 2011–2021, Springer Nature Link (2023).

[18] Robert D. Atkinson & Ian Tufts, The Hamilton Index, 2023: China Is Running Away With Strategic Industries, Information Technology & Innovation Foundation (2023).

[19] Niels Graham, The U.S. Is Relying More on China for Pharmaceuticals — and Vice Versa, Atlantic Council (2023).

[20] Niels Graham, The U.S. Is Relying More on China for Pharmaceuticals — and Vice Versa, Atlantic Council (2023).

[21] Testimony of Dr. Janet Woodcock, Director of the Center for Drug Evaluation and Research, Food and Drug Administration, before the House Committee on Energy and Commerce, Subcommittee on Health, “Safeguarding Pharmaceutical Supply Chains in a Global Economy” (2019).

[22] Sandra Barbosu, Not Again: Why the United States Can’t Afford to Lose Its Biopharma Industry, Information Technology & Innovation Foundation (2024).

[23] Fact Sheet: The United States Announces New Investments and Resources to Advance President Biden’s National Biotechnology and Biomanufacturing Initiative, The White House (2022).

[24] Fact Sheet: President Biden Announces New Actions to Strengthen America’s Supply Chains, Lower Costs for Families, and Secure Key Sectors, The White House (2023).

[25] H.R.8333, BIOSECURE Act (2024) passed by the U.S. House in September 2024. The Senate companion, S. 3558 failed to pass the Senate.

[26] Elijah Moore, The BIOSECURE Act and Its Impact on U.S. Biopharma Expansion, Site Selection Group (2024).

[27] Trade Association Survey Shows 79% of US Biotech Companies Contract with Chinese Firms, Reuters (2024).

[28] Elijah Moore, The BIOSECURE Act and Its Impact on U.S. Biopharma Expansion, Site Selection Group (2024).

[29] Takeda’s Plasma-derived Therapies Manufacturing Facility, Japan, Pharmaceutical Technology (2023).

[30] Competitive Landscape of Biosimilars in Korea, Aranca (2024).

[31] H.R.8333, BIOSECURE Act (2024).

[32] Amy Lv & Tony Munroe, China Bans Export of Critical Minerals to US as Trade Tensions Escalate, Reuters (2024).

[33] The Cost Efficiency of Continuous Biomanufacturing for First-in-Human Biopharmaceutical Supply, Evotec (2024).

[34] Digitization, Automation, and Online Testing: Embracing Smart Quality Control, McKinsey & Company (2021).

[35] Guadalupe Hayes-Mota, AI Is Rapidly Transforming Drug Discovery, Forbes (2024).

[36] Charles Yang, Self-Driving Labs: AI and Robotics Accelerating Materials Innovation, CSIS (2024); Chris Hubbuch, ‘Self-Driving Lab’ Speeds Protein Discovery Process, Wisconsin Energy Institute (2024).

[37] Distribution of Leading 50 Investors Involved in AI in Drug Discovery Worldwide as of 2023, by Region, Statista (2023).

[38] Sandra Barbosu, Harnessing AI to Accelerate Innovation in the Biopharmaceutical Industry, Information Technology & Innovation Foundation (2024).

[39] Emerging Technologies in Pharmaceutical Manufacturing: Modular and Automated Platforms, Frost & Sullivan (2024).

[40] Jan Kaiserle, Single-Use Bioreactors Plateau, Other Single-Use Tech On the Rise, Biopharma Curated (2024).

[41] Marquerita Algorri, et al., Considerations for a Decentralized Manufacturing Paradigm, International Society for Pharmaceutical Engineering (2023).