2025 Analysis

| Assessment: PRC-Lead | Confidence Interval: High |

| Direction: Trend PRC | Confidence Interval: High |

________

China Maintains Lead Amid Rising U.S. Security Concerns

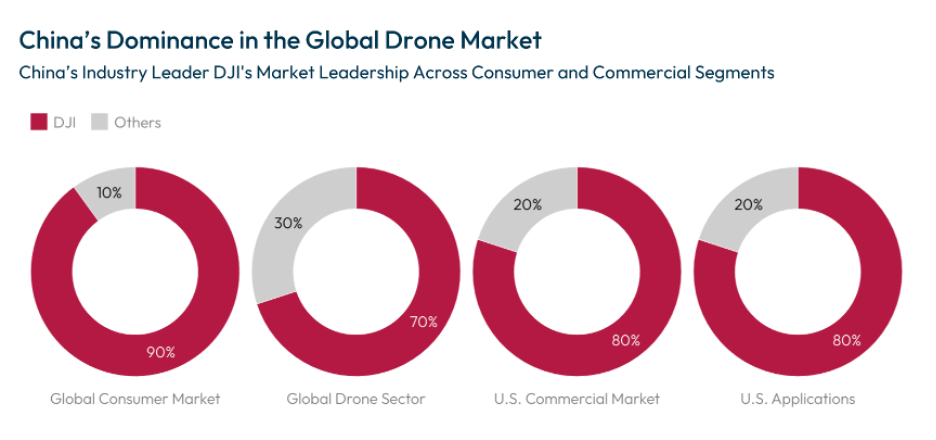

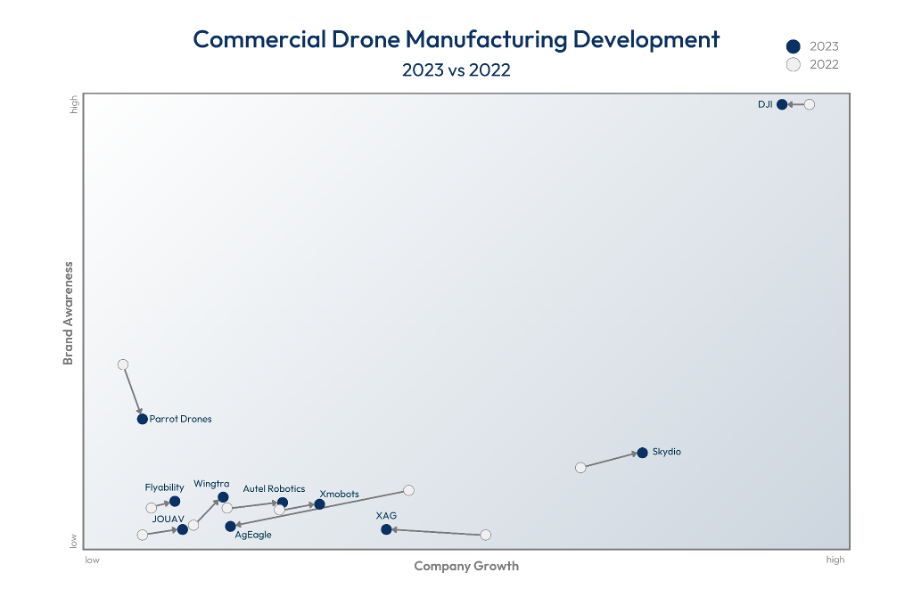

China continues to maintain its substantial lead in the global commercial drone market, with industry leader DJI holding over 90% of the global consumer market[1] and nearly 70% of the overall drone sector,[2] while other companies including Autel continue to gain market share.[3] In the U.S. market alone, DJI holds close to 80% of the commercial segment.[4] This dominance is driven not only by DJI’s scale, competitive pricing, and advanced features but also by significant government support,[5] which has strengthened China’s drone industry and enabled PRC firms to consistently outperform U.S. competitors. The PRC’s stronghold on the commercial drone sector has raised security concerns in the United States, particularly as PRC drones have demonstrated military applications in recent conflicts.[6] Despite various U.S. initiatives to reduce dependency, American drones often remain more expensive, glitch-prone, and challenging to repair than their PRC-made alternatives.[7] As a result, DJI products continue to account for 70 to 90% of drones used across U.S. commercial, government, and consumer applications,[8] leaving China’s dominance in the commercial drone supply chain largely unchallenged.

Source: Ed Alvarado, Ranking the Leading Drone Manufacturers, Drone Industry Insights (2023).

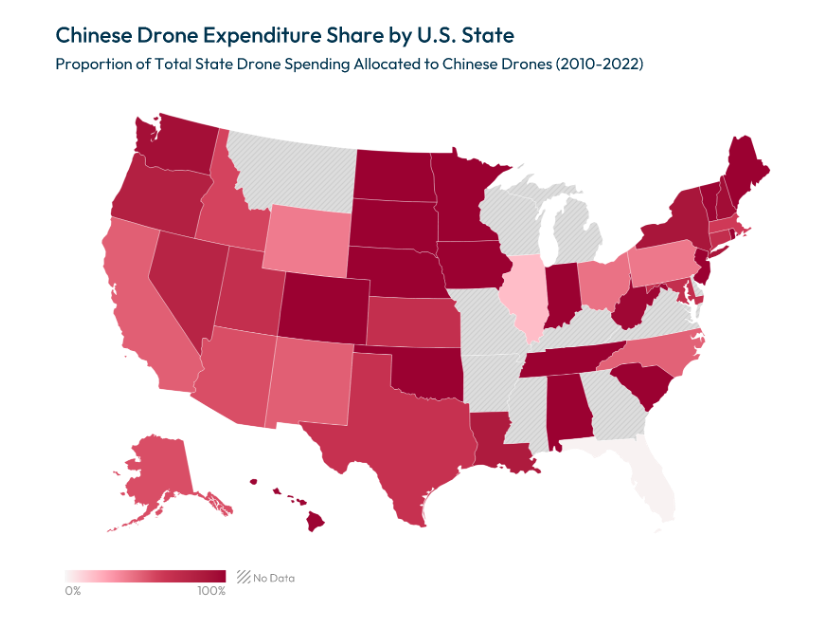

In the broader context of the U.S.-China technology competition, the reliance on PRC drones within U.S. government agencies serves as an example of the pervasive dependency on PRC-manufactured drones. From 2010 to 2022, on average 85% of drones purchased by state agencies were PRC-made, underscoring how entrenched this dependency has become at all levels.[9]

Source: Securing the Skies: Chinese Drones and U.S. Cybersecurity Risks, Foundation for American Innovation (2023).

Wildcards

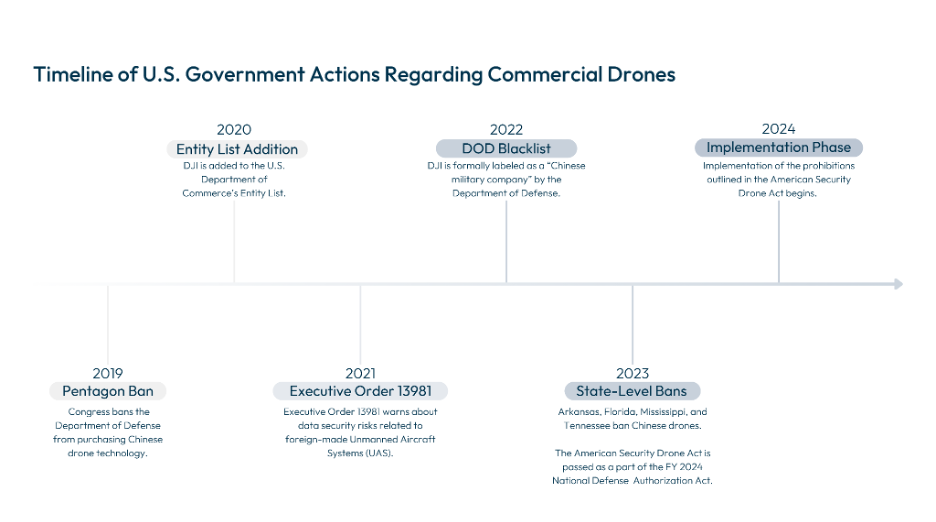

- Are Market Access Restrictions Enough to Stop China’s Drone Dominance? Since 2017, the U.S. Army has banned PRC-origin drones over security concerns,[10] and the American Security Drone Act of 2023 extended these restrictions to all federal entities.[11] Some agencies, like the Department of the Interior (DOI), allowed limited use of PRC drones for emergencies, but the broader restrictions still disrupted operations.[12] In 2022, the DOI permitted non-emergency use under procurement rules that remain in effect as of 2024, with certain exemptions for critical missions like wildfire management, where alternatives were either too costly or less capable. As the incoming administration considers the trade-offs of restricting or banning the sale of PRC-origin drones, PRC drone manufacturers will likely continue to dominate other markets, barring a breakout domestic supplier or international action.[13]

Source: Timeline of U.S. Federal Government Activity Identifying and Addressing Unsecure sUAS, Association for Uncrewed Vehicle Systems International (2024); Lars Erik Schönander, States Push Back Against Chinese Drones, The Hill (2023).

- Could China’s Retaliatory Actions Against U.S. Commercial Drone Companies Accelerate Supply Chain Realignment? China’s recent export controls on U.S. drone companies, which cut off access to essential components like batteries and are forcing U.S. firms to seek alternative suppliers,[14] underscore Beijing’s readiness to use supply chain dependencies as leverage amid escalating U.S.-China tensions. PRC actions could stimulate investment in U.S. manufacturing and innovation or push firms to look toward non-PRC sourcing of drone components. Although this alone does not address the technical sophistication and price competitiveness of PRC drones, it could sow the seeds for a potentially building a more resilient and secure domestic supply chain

What to Watch

- Software and AI Capabilities Will Define the Next Phase of Drone Competition. The future of competition in commercial drones is likely to move from hardware to software and AI-enabled capabilities, offering the United States an opportunity to leverage its strengths. The United States is beginning to see early wins in the competitive drone landscape, signaling potential.[15] Nearly 300 U.S.-based drone technology companies have raised approximately $2.5 billion in venture capital since 2022,[16] underscoring strong investor confidence in this sector. As hardware becomes commoditized, advancements in autonomous navigation, AI-driven data processing, and secure data transmission will become essential differentiators. U.S. firms focused on software and cybersecurity may gain a competitive edge by developing secure, decentralized systems for data control, catering to clients prioritizing data privacy and compliance with Western security standards.

- Taiwan Seeks to Become America’s New Production Hub for Drones. In March 2024, Taiwan’s newly elected president affirmed Taiwan’s ambitions to become the “Asian center for the democratic drone supply chain,” with backing from U.S. partnerships.[17] Taiwan and the United States have been exploring collaborations to reduce reliance on PRC-origin drone components,[18] reflecting lessons learned from Ukraine, where electronic warfare has highlighted the value of AI-driven, resilient drone systems.

- Swarm Technology Emerges as the Next Frontier in Commercial Drone Applications. Emerging technologies like swarm capabilities — which enable the coordinated operation of multiple drones — are expected to play a vital role in commercial[19] and defense[20] applications. China has aggressively pursued swarm technology, with field deployments already in progress,[21] while U.S. firms face stricter regulatory controls, potentially impacting their development timelines.

[1] Zeyi Yang, Why China’s Dominance in Commercial Drones Has Become a Global Security Matter, MIT Technology Review (2024).

[2] Ishveena Singh, The Secret to DJI’s Drone Market Dominance: Revealed, DroneDJ (2024).

[3] Gina Chon, DJI Is a More Elusive U.S. Target Than Huawei, Reuters (2021).

[4] Brad Dress, China’s Dominant Drone Industry Is a Step Ahead of Congress, The Hill (2024).

[5] Whitepaper: AUVSI Partnership for Drone Competitiveness, AUVSI Partnership for Drone Competitiveness, (2024).

[6] Paul Mozur & Valerie Hopkins, Ukraine’s War of Drones Runs Into an Obstacle: China, New York Times (2023; Hannah Beech & Paul Mozur, Drones Changed This Civil War, and Linked Rebels to the World, New York Times (2024).

[7] Heather Somerville, Why First Responders Don’t Want the U.S. to Ban Chinese Drones, Wall Street Journal (2024).

[8] Heather Somerville, Why First Responders Don’t Want the U.S. to Ban Chinese Drones, Wall Street Journal (2024).

[9] Lars Schönander, Securing the Skies: Chinese Drones and U.S. Cybersecurity Risks, Foundation for American Innovation (2023).

[10] Timeline of U.S. Federal Government Activity Identifying and Addressing Unsecure UAS, Association for Uncrewed Vehicle Systems International (2024); Eric Holdeman, Federal Government Will Require Purchase of ‘Made in America’ Drones, Government Technology (2024).

[11] American Security Drone Act Of 2023, General Services Administration (last accessed 2024); Gallagher, Colleagues Introduce Bipartisan American Security Drone Act, The Select Committee on the Chinese Communist Party (2023).

[12] Jaron Schneider, U.S. Department of the Interior Says Anti-DJI Regulation Hurt Its Operations, PetaPixel (2024).

[13] David Shepardson, US Considers Potential Rules to Restrict or Bar Chinese Drones, Reuters (2025).

[14] Agence France Presse, U.S. Drone Maker Says China Sanctions To Hit Supply Chain, Barron’s (2024).

[15] Heather Somerville, American Drone Startup Notches Rare Victory in Ukraine, Wall Street Journal (2024).

[16] Heather Somerville & Brett Forrest, How American Drones Failed to Turn the Tide in Ukraine, Wall Street Journal (2024).

[17] Joyu Wang, Taiwan Wants a Drone Army — but China Makes the Drones It Wants, Wall Street Journal (2024).

[18] Chris Buckley & Amy Chang Chien, Taiwan and U.S. Work to Counter China’s Drone Dominance, New York Times (2024).

[19] Ed Alvarado, Commercial Use of Drone Swarms, Drone Industry Insights (2024).

[20] Zachary Kallenborn, Swarm Clouds on the Horizon? Exploring the Future of Drone Swarm Proliferation, Modern War Institute (2024).

[21] Military and Security Developments Involving the People’s Republic of China 2024, U.S. Department of Defense (2024).