2025 Analysis

| Assessment: PRC Lead | Confidence Interval: High |

| Direction: Trend PRC | Confidence Interval: High |

________

China Still Leads in 5G Infrastructure.

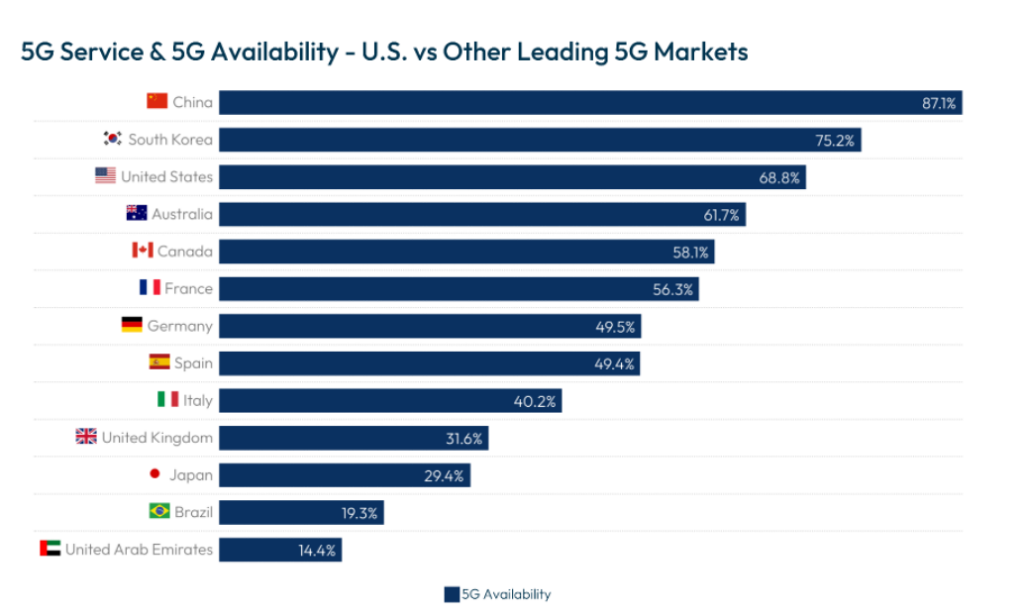

Despite similar annual capital expenditures of roughly $50 billion by major telecom operators[1][2] China outpaces the United States in 5G infrastructure deployment.[3] With over 4 million base stations reportedly deployed (equating to 206 per 100,000 residents) compared to the United States’ approximate 100,000 base stations (77 per 100,000 residents),[4] China has achieved a scale advantage that allows for broader, denser, and more affordable network coverage.[5] China surpassed 1 billion 5G connections in 2024,[6] covering 88% of its mobile users,[7] whereas the United States lags at approximately 45%.[8] Overall download speeds are marginally higher in China at 139 Mbps,[9] compared to 123 Mbps in the United States.[10]

PRC firms like Huawei and ZTE dominate the global exportable hardware market, leveraging competitive pricing, state-backed funding, and rapid deployment to outperform U.S. and allied competitors.[11] China also excels in 5G network processing,[12] integrating advanced hardware capable of managing massive data volumes.[13] Although the United States holds a larger share of wireless spectrum, which is critical for expanding capacity,[14] challenges in spectrum allocation and management have hindered its deployment.[15] Conversely, China has optimized mid-band spectrum use, achieving a balance between coverage and speed.[16] While U.S. providers turn their attention[17] to developing AI-powered advanced networks[18] — including private 5G networks[19] and edge computing solutions[20] — these efforts remain nascent compared to China’s more mature deployment.[21]

Source: 5G in the U.S. — Additional Mid-Band Spectrum Driving Performance Gains, Ookla (2024).

Wildcards

- Will the U.S. Government Break the 5G Logjam? The second Trump Administration is expected to restart previous efforts to replace PRC equipment in U.S. and allied networks with trusted alternatives.[22] The Trump Administration’s planned deregulatory efforts[23] could extend to easing infrastructure deployment,[24] including for private 5G networks, which will prove decisive in integrating network technologies[25] with emerging IoT applications.[26] In the FY25 National Defense Authorization Act, Congress provided the Federal Communications Commission (FCC) with $3 billion[27] to execute the Trump-signed rip and replace program,[28] which aims to eliminate reliance on PRC communications technology.[29] However, the program remains impeded by years of chronic underfunding[30] and supply chain disruptions.[31] Improved spectrum management, which could support greater network deployment, remains a challenge. Congress has yet to renew the FCC’s authority,[32] which lapsed in March 2023, to auction and streamline underutilized government spectrum.[33] The resolution of this legislative bottleneck, while aligning regulatory overhauls with infrastructure rollout, will be pivotal in accelerating 5G progress and ensuring the United States can compete in the global telecommunications race.

- Will Open RAN Pan Out? The United States may leverage allied and partner capabilities through strategic partnerships with European telecom operators such as Nokia, Ericsson, and T-Mobile. Although such partnerships are unlikely to close the infrastructure gap with China, they could bolster domestic 5G infrastructure while enhancing capabilities in advanced network technologies like Open Radio Access Network (RAN)[34] and AI-driven network management.[35] Open RAN has generated excitement for its ability to allow operators to mix and match hardware and software components from multiple vendors, while diversifying supply chains and being cost effective.[36] As the technology is still maturing,[37] it is facing concerns about its performance, security, and integration, thereby slowing deployment.[38] Furthermore, China’s investments in proprietary alternatives and its influence in emerging markets through cost-effective turnkey solutions[39] challenge[40] Open RAN’s global adoption.[41] While the United States and allies grapple with Beijing’s increasing subterfuge of the global telecommunications infrastructure,[42] Open RAN’s success will depend on overcoming technical maturity issues, ensuring interoperability, leveraging allied capabilities, and addressing security considerations[43] to provide competitive alternatives, particularly in price-sensitive regions.

What to Watch

- Step-Changes to 5G Architectures May Spur New Commercial Applications. The integration of AI into advanced networks is poised to define the next phase of 5G competition. The lack of compelling commercial use cases has so far hindered widespread adoption of 5G in the United States.[44] However, the convergence of AI with 5G networks[45] has the potential to drive adoption by unlocking new applications across sectors such as agriculture,[46] manufacturing,[47] and defense.[48] These emerging use cases could partially offset infrastructure gaps and position the United States to capitalize on its strengths in AI and software innovation. As China makes strides[49] in network slicing technology[50] — a capability critical for industrial IoT — the United States may leverage its strengths in AI, software, and cloud services to accelerate the rollout of private 5G networks and 5G RedCap (Reduced Capability), designed for IoT applications requiring lower power and cost.[51] Addressing existing security concerns around Open RAN could potentially reshape the competitive landscape by reducing reliance on single-vendor solutions and diversifying global supply chains.

- The Ongoing Battle for Influence over 6G Standards. Although 6G networks are not expected until 2030,[52] the development of technical standards for 6G will be a pivotal battleground.[53] In September 2024, the International Telecommunication Union (ITU) adopted[54] three 6G standards proposed by the Chinese Academy of Sciences[55] and China Telecom. While China’s dominance in 5G infrastructure positions it favorably for shaping future standards, the United States is collaborating with allies and partners to develop shared principles for 6G.[56] As the 5G race moves into its next phase and the groundwork for 6G is laid, technological advancements, strategic partnerships, and the ability to shape standards will determine long-term leadership in the global telecommunications ecosystem.

[1] Mike Dano, For 5G Vendors in the US, The Worst May Be Over, Light Reading (2024).

[2] Kenji Kawase, Chinese State Telecoms’ 5G Investment Tops Out While Dividends Surge, Nikkei Asia (2024).

[3] Maciej Biegajewsk, Why China Is Winning the 5G Race — And What the West Doesn’t Want You to Know!, RFBenchmark (2024).

[4] Juan Pedro Tomas, China Reaches Over 4 million 5G Base Stations, RCR Wireless (2024); Number of 5G Base Stations in Selected Countries Worldwide 2023, Statista (2024); The 5G Marathon, KPMG UK (2024).

[5] Dan Strumpf, U.S. vs. China in 5G: The Battle Isn’t Even Close, Wall Street Journal (2020).

[6] China’s 5G ‘Subs’ Climb to 1.15 billion, Telecom TV (2024).

[7] Catherine Sbeglia Nin, China to surpass 1 billion 5G Connections this year, RCR Wireless (2024).

[8] Petroc Taylor, 5G in the United States, Statista (2024).

[9] China’s Mobile and Broadband Internet Speeds, Speedtest Global Index (last accessed 2024).

[10] United States’s Mobile and Broadband Internet Speeds, Speedtest Global Index (last accessed 2024).

[11] Ngor Luong, Forging the 5G Future: Strategic Imperatives for the US and its Allies, Atlantic Council (2024).

[12] Kitty Wheeler, The Impact of China Unicom & Huawei’s 5G-Advanced Network, Technology Magazine (2024).

[13] China Mobile Breaks the Data Processing Bottleneck, Intel (last accessed 2024).

[14] Mark Giles, 5G in the U.S. – Additional Mid-band Spectrum Driving Performance Gains, Ookla (2024).

[15] Ling Zhu, National Spectrum Policy: Interference Issues in the 5G Context, Congressional Research Service (2022).

[16] The U.S. vs. China: The Path to Securing Wireless Leadership, Axios (2024).

[17] Kavit Majitha, Verizon Strategy Boss Turns Attention to 5G-Advanced, Mobile World Live (2022).

[18] The integration of 5G-A and AI, Unleashing Technological Potential and Promoting Industry Innovation, Data Center Dynamics (2024).

[19] Suman Bhattacharyya, Telecom Companies Pin 5G Hopes on Private Industrial Networks, Wall Street Journal (2023).

[20] 5G and Edge Computing: Why Does 5G Need Edge?, STL Partners (last accessed 2024).

[21] Harry Baldock, China Unicom and Huawei Showcase 5G-Advanced with New Beijing Deployment, Total Telecom (2024).

[22] Dean DeChairo, Trump Order Clears Path to Ban Huawei 5G Equipment from United States, Roll Call (2019); Mark Scott, How Trump Won Over Europe on 5G, Politico (2021).

[23] Trump Inc.: How a Second Administration Could Rewrite the Way America Does Business, Wall Street Journal (2024).

[24] Scott Patterson, Trump Pledges to Speed Permitting for Companies Investing Over $1 Billion, Wall Street Journal (2024).

[25] Satyajit Sinha, State of Private 5G in 2024: Key Growth Trends, Use Cases, and Forecast, IoT Analytics (2024).

[26] What is IoT? – Internet of Things Explained, Amazon Web Services (last accessed 2024).

[27] H.R. 5009, Servicemember Quality of Life Improvement and National Defense Authorization Act for Fiscal Year 2025 at Sec. 5404(c) (2024); Eduard Kovacs, 2025 NDAA Provides $3 Billion Funding for FCC’s Rip-and-Replace Program, SecurityWeek (2024).

[28] President Signs Rip and Replace Bill Into Law, U.S. Senate Committee on Commerce, Science, & Transportation (2020).

[29] Jill C. Gallagher, Secure and Trusted Communications Networks Reimbursement Program: Frequently Asked Questions, Congressional Research Service (2023).

[30] Jake Neenan, Rip-and-Replace Continues to Feel Funding Shortfall, FCC Says, Broadband Breakfast (2024).

[31] Nicole Ferraro, FCC approves more ‘rip-and-replace’ extensions due to supply chain, Light Reading (2024).

[32] Patricia Moloney Figliola & Jill C. Gallagher, The Federal Communications Commission’s Spectrum Auction Authority: History and Options for Reinstatement, Congressional Research Service (2023).

[33] Monica Alleven, AT&T Says It’s Not Getting ‘Windfall’ from 4.9 GHz Spectrum, Fierce Network (2024).

[34] Explore Open RAN: Innovation and Flexibility, Ericsson (last accessed 2024).

[35] Dan Jones, T-Mobile Readies 5G-Advanced Launch at ‘The End of the Year’, Fierce Network (2024).

[36] Chair Latta Opening Remarks on Strengthening American Communications Leadership with Open Radio Access Networks, U.S. House Committee on Energy & Commerce (2024).

[37] O-RAN: Challenges and Prospects on the Road to Maturity, LitePoint (2023).

[38] The Opportunities and Challenges of Open RAN: What it Means for the Future of Telecom, RCR Wireless (2024).

[39] Manoj Harjani, O-RAN is Overhyped as Avoiding Chinese 5G Influence, Australian Strategic Policy Institute (2024).

[40] Iain Morris, How Huawei and Open RAN Misfires Hurt Ericsson, Nokia and Telcos, Light Reading (2024).

[41] Chris Antilitz, Open RAN Adoption in 2024, TBR Insight Center (2024).

[42] Dustin Volz, Dozens of Countries Hit in Chinese Telecom Hacking Campaign, Top U.S. Official Says, Wall Street Journal (2024).

[43] Open Radio Access Networks Security Considerations, Cybersecurity and Infrastructure Security Agency (2024).

[44] The Challenge of Monetizing 5G, PwC (2023).

[45] Baris Kavakli, Why 5G needs AI: A Technology-Driven Revolution Lacking Initial User Demand, Portera (2024).

[46] How 5G Networks Support Precision Agriculture, Avnet (2023).

[47] Dan Omalley, 5G in Manufacturing: The Key to Industry 4.0, NYBSYS (2024).

[48] Leland Brown & Stan Mo, How to Combine 5G networks, Artificial Intelligence to Aid Warfighters, C4ISR (2022).

[49]Joe Madden, Network Slicing is Alive in China, Fierce Network (2022).

[50] Kinza Yasar & John Burke, What is Network Slicing?, Tech Target (2024).

[51] What is 5G RedCap? Exploring Benefits and Use Cases, Telenor IoT (last accessed 2024).

[52] Arjun Kharpal, Tech Next-Gen Mobil Internet — 6G — Will Launch in 2030, Telecom Bosses Say, Even as 5G Adoption Remains Low, CNBC (2023).

[53] Ananmay Agarwal, The Silent Struggle: How Technical Standards Shape Global Tech Power, Special Competitive Studies Project (2024).

[54] Rimjhim Singh, China’s ITU-Approved 6G Standards Set Stage for Advanced Telecom Solutions, Business Standard (2024).

[55] Cole McFaul et. al, Fueling China’s Innovation: The Chinese Academy of Sciences and Its Role in the PRC’s S&T Ecosystem, Center for Security and Emerging Technology (2024).

[56] Joint Statement Endorsing Principles for 6G: Secure, Open, and Resilient by Design, The White House (2024).