2025 Analysis

| Assessment: U.S.-Lead | Confidence Interval: High |

| Direction: Trend Contested | Confidence Interval: Low |

________

The U.S. Lead in Fusion Energy is Narrowing

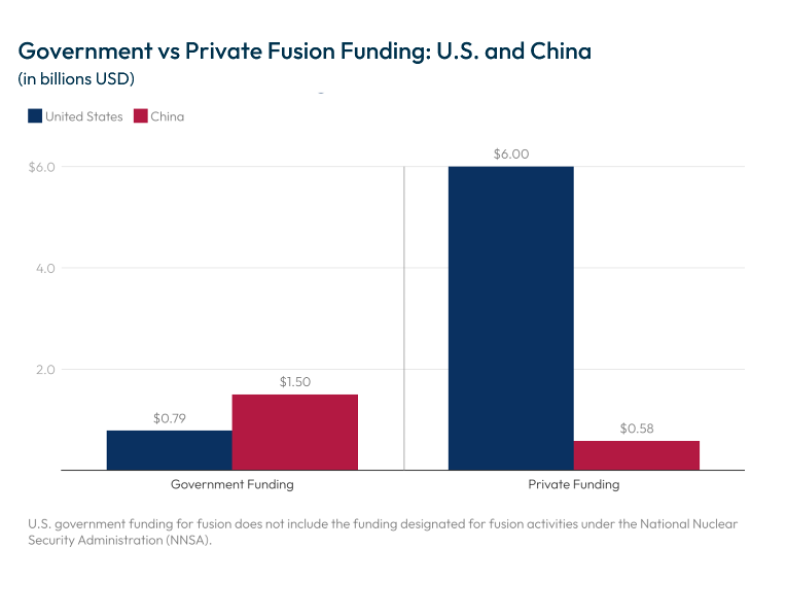

The fusion energy competition between the United States and China is more contested than ever before. While the United States still benefits from cutting-edge research and robust industry investment, China is moving rapidly to close the gap. The Lawrence Livermore National Laboratory’s (LLNL) National Ignition Facility (NIF) achieved a historic milestone in December 2022 by producing more energy from fusion than was put into the reaction[1] — an achievement hailed as “one of the most significant scientific achievements of the 21st century.”[2] This breakthrough, consistently reproduced[3] and unmatched by any other nation, marks a pivotal step toward commercial fusion energy. Recent progress in AI, physics, and applied science has broadened the U.S. fusion ecosystem beyond national labs, with 25 of the world’s 45 active fusion companies based in the United States, collectively raising over $6 billion of the $8 billion[4] in total global private fusion investment. In contrast, China’s three known fusion companies have secured a combined $580 million.[5]

China’s commitment to catching up is evident in its strategic approach[6] to government funding in fusion energy, which mimics[7] U.S. development plans,[8] national laboratory models, and company strategies.[9] Although the U.S. Department of Energy’s (DOE) Fusion Energy Sciences (FES) budget reached $790 million in FY2024,[10] Beijing invests nearly twice that amount — about $1.5 billion annually – though gaining a detailed understanding of PRC government spending can be elusive.[11] Additionally, while these funding comparisons appear straightforward, the distinction between government and private sector investment in China is often less clear-cut than in the United States because many PRC companies maintain close state ties, align with national priorities, and receive significant state funding. China is focused on commercialization by directing most of its funding toward facilities that can compete with leading U.S. private companies.[12] Much of U.S. fusion spending, on the other hand, supports legacy programs rather than cutting-edge development[13] and nearly one-third of the annual FES budget[14] goes to the delayed International Thermonuclear Experimental Reactor (ITER) project in France.[15]

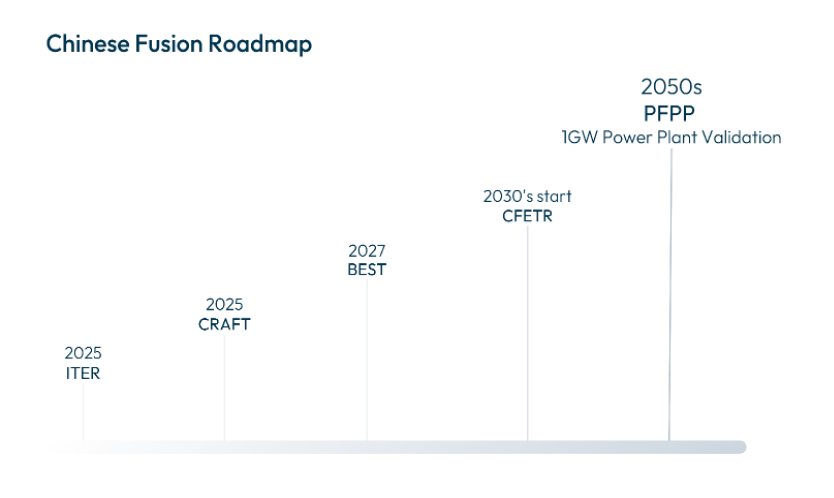

China is already translating its funding and commercialization focus into action, constructing infrastructure that spans every stage of fusion development.[16] The Experimental Advanced Superconducting Tokamak (EAST) supports advanced research, while the Comprehensive Research Facility for Fusion Technology (CRAFT)[17] and the Burning Experimental Superconducting Tokamak (BEST)[18] drive development efforts. The China Fusion Engineering Test Reactor (CFETR)[19] serves as a demonstration platform, all leading toward a future gigawatt-scale power plant. By contrast, the United States excels at research but relies more on private companies for development and demonstration, with no national deployment facility planned. China’s integrated approach may allow it to move more quickly toward full-scale commercial fusion power.

Source: Jean Paul Allain, Building Bridges: A Bold Vision for the DOE Fusion Energy Sciences, U.S. Department of Energy (2023).

Beyond infrastructure, China’s human capital and intellectual property advantages add to its momentum. It produces ten times as many Ph.D.s in fusion science and engineering as the United States[20] and surpassed American fusion technology patent application filings in 2023.[21] Its fusion workforce operates with remarkable efficiency, keeping facilities running nearly nonstop. Experts predict that at this rate, China could overtake U.S. and European magnetic fusion capabilities within three to four years.[22] Although the United States leads in foundational research and total private investment, breakthroughs alone may not preserve that lead. Achieving commercial fusion requires coordinated efforts that bridge the gap between laboratory success and scalable power plants — an area where China’s comprehensive, state-backed strategy may ultimately give it the upper hand.

Wildcards

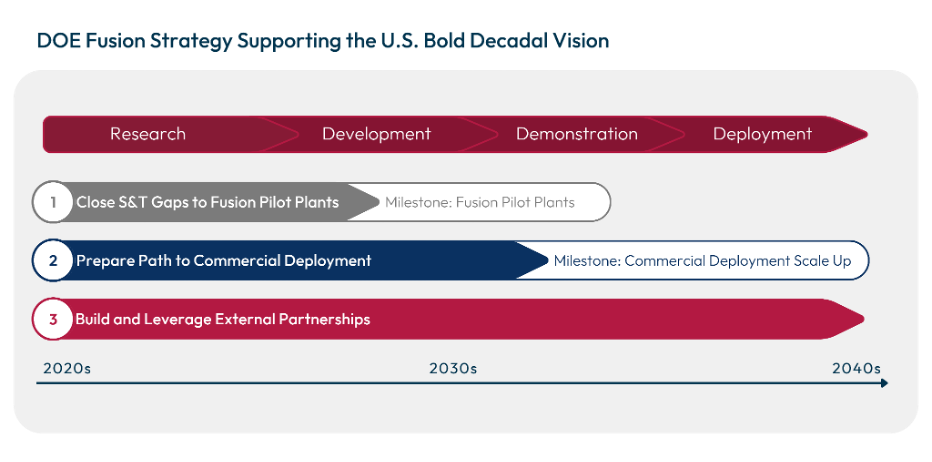

- Will New Federal Programs Bridge the Public-Private Development Gap? Building on the 2022 Bold Decadal Vision,[23] recent U.S. initiatives aim to push fusion toward commercialization. The DOE’s 2024 Fusion Energy Strategy focuses on three pillars: bridging technological gaps for a pilot plant, enabling sustainable deployment, and forging external partnerships.[24] It identifies near-term challenges in the 2020s (capital flow, materials, regulations), mid-term issues in the 2030s (infrastructure and supply chains), and large-scale hurdles in the 2040s.[25] New efforts like the $45 million FIRE Collaboratives[26] provide testing infrastructure that private firms cannot develop on their own, while the Milestone-Based Fusion Development Program seeks to reduce investment risk.[27] However, spending lags behind authorized funds,[28] and two forthcoming developments — the DOE’s 2025 commercialization roadmap[29] and the ADVANCE Act’s potential licensing reforms[30] — could either accelerate progress or introduce new uncertainties.

Source: Fusion Energy Strategy 2024, U.S. Department of Energy (2024).

- How Will China’s Supply Chain Control Impact U.S. Fusion Progress? China is expanding its influence beyond research advances, positioning it to control portions of the fusion supply chain by securing critical materials and components.[31] Although the U.S. currently excels in some technologies (lasers, superconductors, software), China’s dominance in rare earths, high-quality manufacturing, and mass production is poised to create vulnerabilities for American firms – particularly given uncertain long-term demand signals and a shortage of skilled workers.[32] This strategic approach mirrors its success in solar panels and electric vehicle batteries,[33] potentially limiting the United States’ ability to scale fusion engineering breakthroughs into commercial reactors. While new DOE programs and regulatory reforms may speed U.S. development, true leadership in fusion will also require securing supply chains — a lesson reinforced by China’s track record of leveraging control over critical minerals to shape entire industries.

What to Watch

- AI Technologies Accelerate Critical Breakthroughs in Fusion Development. AI is emerging as a powerful tool in fusion, enabling both the United States and China to push beyond conventional trial-and-error approaches. The United States is applying AI across multiple fronts: Google’s advanced AI systems enhance reactor efficiency,[34] Princeton Plasma Physics Laboratory’s AI platforms predict and prevent plasma instabilities in real time,[35] and LLNL’s cognitive simulation methods helped achieve fusion ignition by optimizing experimental designs.[36] China has also harnessed AI, using neural networks trained on extensive plasma data sets to improve measurement speeds by a factor of ten.[37] These advances, coupled with sophisticated modeling and simulation environments like the Idaho National Laboratory’s MOOSE and FENIX frameworks, can accelerate learning, tackle persistent engineering challenges,[38] and ultimately bring fusion closer to commercial reality.

- Nuclear Infrastructure Development Shapes the Path to Fusion Commercialization. As fusion moves toward commercialization, existing nuclear infrastructure provides a strategic advantage.[39] China’s rapidly expanding nuclear industry leads the world in conventional reactor construction, with 22 of the 58 reactors under development globally and the first Small Modular Reactor (SMR) now in commercial operation.[40] In contrast, the United States faced hurdles in building new reactors[41] and, as of August 2024, had none under construction.[42] However, in November 2024, the U.S. Nuclear Regulatory Commission approved the first Generation IV power-producing reactor authorized for construction in the country.[43] The presence or absence of supporting nuclear infrastructure could influence how quickly each nation transitions from demonstration to deployment of fusion power.

- International Partnerships Emerge as Key Differentiators in Fusion Competition. Global alliances are becoming increasingly important in shaping fusion’s future.[44] Recent U.S. partnerships with the United Kingdom[45] and Japan[46] focus on sharing facilities, harmonizing regulations, and bolstering supply chain resilience—moves that could offset China’s tightly integrated domestic ecosystem. These collaborations aim to accelerate progress, reduce costs, and maintain leadership as the window for securing a dominant position narrows. Without timely, coordinated action, the United States risks ceding ground in the race to commercialize what may become the defining energy technology of the century.

[1] Breanna Bishop, Lawrence Livermore National Laboratory Achieves Fusion Ignition, Lawrence Livermore National Laboratory (2022).

[2] Jeremy Thomas, A Shot for the Ages: Fusion Ignition Breakthrough Hailed as ‘One of the Most Impressive Scientific Feats of the 21st Century’, Lawrence Livermore National Laboratory (2022).

[3] Jeff Tollefson, U.S. Nuclear-Fusion Lab Enters New Era: Achieving ‘Ignition’ Over and Over, Nature (2023).

[4] 2024 Global Fusion Industry Report, Fusion Industry Association (2024).

[5] 2024 Global Fusion Industry Report, Fusion Industry Association (2024).

[6] Losing the Race for Nuclear Fusion, Special Competitive Studies Project (2024).

[7] Opening Statement of Chairman Joe Manchin, before the Senate Energy and Natural Resources Committee, Full Committee Hearing to Examine Fusion Energy Technology Development (2024).

[8] Powering the Future: Fusion & Plasmas, Fusion Energy Sciences Advisory Committee (2020).

[9] Angela Dewan & Ella Nilsen, The U.S. Led on Nuclear Fusion for Decades. Now China Is in Position to Win the Race, CNN (2024).

[10] Congress Increases U.S. Funding for Fusion Energy Sciences Research, Fusion Industry Association (2024).

[11] Jean Paul Allain, Building Bridges: A Bold Vision for the DOE Fusion Energy Sciences, Office of Science for Fusion Energy Sciences (2023).

[12] Jennifer Hiller & Sha Hua, China Outspends the U.S. on Fusion in the Race for Energy’s Holy Grail, Wall Street Journal (2024).

[13] Jennifer Hiller & Sha Hua, China Outspends the U.S. on Fusion in the Race for Energy’s Holy Grail, Wall Street Journal (2024).

[14] The Current U.S. Approach to Fusion, Special Competitive Studies Project (2024).

[15] Elizabeth Gibney, ITER Delay: What It Means for Nuclear Fusion, Nature (2024).

[16] Testimony of Patrick White, before the U.S. Senate Committee on Energy and Natural Resources, Full Committee Hearing to Examine Fusion Energy Technology Development (2024).

[17] Victoria Bela, China Launches ‘Kuafu’ Nuclear Fusion Research Facility, Named After Mythical Giant, in Quest to Build ‘Artificial Sun’, South China Morning Post (2023).

[18] China New Growth: Controlled Nuclear Fusion Emerges as New Frontier for China’s Venture Capitalists, Xinhua (2024).

[19] Research, Institute of Plasma Physics, Chinese Academy of Sciences (last accessed 2024).

[20] Jennifer Hiller & Sha Hua, China Outspends the U.S. on Fusion in the Race for Energy’s Holy Grail, Wall Street Journal (2024).

[21] Rimi Inomata, China Tops Nuclear Fusion Patent Ranking, Beating U.S., Nikkei Asia (2023).

[22] Jennifer Hiller & Sha Hua, China Outspends the U.S. on Fusion in the Race for Energy’s Holy Grail, Wall Street Journal (2024).

[23] Readout of the White House Summit on Developing a Bold Decadal Vision for Commercial Fusion Energy, The White House (2022).

[24] Fusion Energy Strategy 2024, U.S. Department of Energy (2024).

[25] Fusion Energy Strategy 2024, U.S. Department of Energy (2024).

[26] DOE Science FY24 Final Appropriation Excerpt, U.S. Department of Energy (2024).

[27] Department of Energy Announces $50 Million for a Milestone-Based Fusion Development Program, U.S. Department of Energy (2022).

[28] DOE Announces $46 Million for Commercial Fusion Energy Development, U.S. Department of Energy (2023).

[29] Fusion Energy Strategy 2024, U.S. Department of Energy (2024).

[30] U.S. Senate Passes ADVANCE Act, Including Legislation to Codify US Fusion Regulations, Fusion Industry Association (2024).

[31] Aaron Larson, U.S. in a Race with China to Develop Commercial Fusion Power Technology, POWER (2024).

[32] Angela Dewan & Ella Nilsen, The U.S. Led on Nuclear Fusion for Decades. Now China Is in Position to Win the Race, CNN (2024).

[33] You Xiaoying, The ‘New Three’: How China Came to Lead Solar Cell, Lithium Battery, and EV Manufacturing, Dialogue Earth (2023).

[34] Pulsar Team & Swiss Plasma Center, Accelerating Fusion Science Through Learned Plasma Control, Google DeepMind (2022).

[35] Jaemin Seo, et al., Avoiding Fusion Plasma Tearing Instability with Deep Reinforcement Learning, Nature (2024).

[36] Jeremy Thomas, High-Performance Computing, AI and Cognitive Simulation Helped LLNL Conquer Fusion Ignition, Lawrence Livermore National Laboratory (2023).

[37] Aman Tripathi, China Achieves Fusion Milestone with 10x Improvement in Plasma Measurement Speed, Interesting Engineering (2024).

[38] Pierre-Clément Simon & Casey Icenhour, Developing the Future of Fusion Energy, Federation of American Scientists (2024).

[39] Stephen Ezell, How Innovative Is China in Nuclear Power?, Information Technology & Innovation Foundation (2024).

[40] Sha Hua, Atomic Power Is In Again—and China Has the Edge, Wall Street Journal (2023).

[41] William Mauldin & Jennifer Hiller, Washington Heats Up Nuclear Energy Competition With Russia, China, Wall Street Journal (2024).

[42] Safely and Responsibly Expanding U.S. Nuclear Energy: Deployment Targets and a Framework for Action, The White House (2024).

[43] Sonal Patel, NRC Approves Construction of First Electricity-Producing Gen IV Reactor in the U.S., Power (2024).

[44] International Partnerships in a New Era of Fusion Energy Development, The White House (2023).

[45] Joint Statement Between DOE and the UK Department for Energy Security and Net Zero Concerning a Strategic Partnership to Accelerate Fusion, U.S. Department of Energy (2023).

[46] Joint Statement Between DOE and the Japan Ministry of Education, Sports, Science and Technology Concerning a Strategic Partnership to Accelerate Fusion Energy Demonstration and Commercialization, U.S. Department of Energy (2024).