2025 Analysis

| Assessment: U.S.-Lead | Confidence Interval: High |

| Direction: U.S.-Lead | Confidence Interval: Moderate |

________

The United States Remains in the Lead as China Looks for Workarounds chip industry.[1]

U.S. export controls on advanced chips and semiconductor manufacturing equipment demonstrate that this sector continues to be a strong point for the United States,[2] though enforcement issues have limited the effectiveness of the restrictions.[3] Collecting accurate open source information on China’s chip industry has also become more challenging since the controls were instituted in 2022, with information on technical progress now treated as state secrets. Still, it is clear that Beijing is investing massive resources in “designing out” U.S. technology and developing fully indigenous GPUs, semiconductor manufacturing equipment, chip design software, and more.[4] The key bottleneck to further progress remains Extreme Ultraviolet Lithography (EUV) tools, which China cannot currently access.

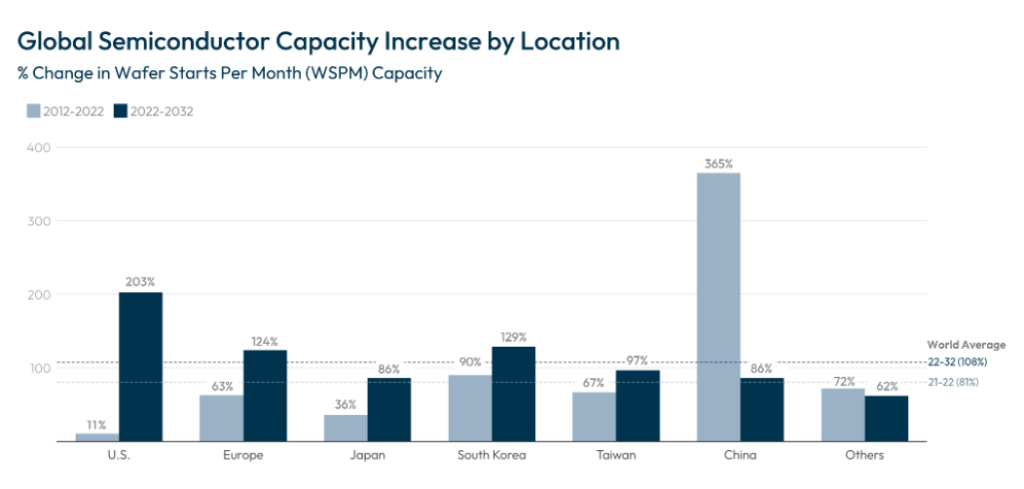

In terms of resilience of domestic supply, the United States has made progress over the past two years. Thanks to $400 billion in private investment catalyzed by the CHIPS Act, the nation is projected to account for 28% of global leading-edge logic chip production in 2032, up from 0% in 2022.[5] Yet, U.S. vulnerabilities remain. First, Taiwan’s unique concentration of expertise and economies of scale means both China and the United States remain reliant on AI chips produced in Taiwan. And second, the PRC has prioritized a massive capacity buildout for legacy semiconductors and is projected to account for 39% of global production by 2027.[6] Such an increase would overwhelm U.S. suppliers and create dependencies in strategic sectors.

Source: 2024 State of the U.S. Semiconductor Industry, Semiconductor Industry Association at 10 (2024).

Wildcards

- Will China Succeed in Reverse-Engineering EUV Lithography Tools? EUV is widely regarded as one of the most complicated technologies humans have ever invented. Initial restrictions on the export of ASML’s advanced lithography tools to China during the first Trump administration is widely credited with slowing Beijing’s efforts to catch up in semiconductor technology. Copying these tools would require a herculean effort, but the PRC has mobilized the full resources of the party-state, pouring billions of dollars into reverse-engineering efforts and assembling a state-backed EUV consortium.[7] If successful, these would drastically change the competitive balance in this sector.

- Whither the CHIPS Act? The incoming administration has indicated skepticism of the CHIPS Act, though initial outreach and investment commitments from TSMC began during the first Trump Administration. Passed on a bipartisan basis, CHIPS has successfully spurred over $400 billion in private investment.[8] Moves to claw back funding or slash R&D could freeze U.S. efforts to build resilience and scale novel paradigms, allowing the PRC to make up ground.

- Who Wins the Race to Scale Novel Devices, Materials, and Architectures? Traditional semiconductor manufacturing is pushing up against the laws of physics, pushing capital costs and energy demand for compute to unsustainable levels. A variety of post-Moore’s Law chip technologies are emerging that could unlock significant gains in performance and power consumption. Technology vectors range from improvements in 3D packaging and heterogeneous integration to novel materials and devices such as spintronics, superconductor electronics, and tunnel field-effect transistors (TFETs). Candidates even include entirely new forms of computation, such as reversible computing and thermodynamic computing. Moving physics breakthroughs from the lab to the fab currently takes about 10 years, but if either the United States or China could manage to this timeline, it would change the dynamics of the competition.

What to Watch

- China’s Progress in Indigenizing the AI Hardware and Software Stack. Weaning China off of dependence on U.S.-headquartered Nvidia for AI chips is a top policy priority for Beijing. Huawei has been tasked to develop an alternative hardware and software stack, though startups like Biren, Moore Threads, and HiSilicon, have also emerged as serious players. China’s degree of success in developing competitive solutions will impact its ability to keep up in large-scale AI systems.

- U.S. Policy Actions on Legacy Chips. China is currently building out more capacity for legacy chips than the rest of the world combined, presenting a major national security and economic challenge for the United States.[9] The Biden Administration raised tariffs on legacy chips from 25% to 50%,[10] but this move left two gaps: chips manufactured outside China by PRC firms, and chips imported as components of other goods. If the new administration addresses these issues early — potentially through component-level tariffs — this would serve as an indicator that the United States will continue to tighten the screws on China’s chip industry.

- China’s Progress in Advanced Packaging. The PRC has targeted advanced packaging as a growth vector and intends to create a domestic chiplet ecosystem. These moves could help mitigate poor yields at SMIC, China’s domestic national champion foundry. In addition, progress in emerging technologies like silicon photonics would boost PRC prospects in AI.

[1] Stephen Ezell, How Innovative Is China in Semiconductors?, Information Technology & Innovation Foundation (2024).

[2] Gregory C. Allen, The True Impact of Allied Export Controls on the U.S. and Chinese Semiconductor Manufacturing Equipment Industries, Center for Strategic and International Studies (2024).

[3] Samuel Hammond & Erich Grunewald, Spreadsheets vs. Smugglers: Modernizing the BIS for an Era of Tech Rivalry, Institute for AI Policy and Strategy (2024).

[4] Paul Triolo, The Evolution of China’s Semiconductor Industry under U.S. Export Controls, American Affairs (2024).

[5] Emerging Resilience In The Semiconductor Supply Chain, Semiconductor Industry Association (2024).

[6] Rumors Regarding Price Reductions in Mature Process for Foundries Emerge, Signaling a Further Decrease in Prices in Q2, Trend Force (2024).

[7] Paul Triolo, A New Era for the Chinese Semiconductor Industry: Beijing Responds to Export Controls, American Affairs (2024).

[8] The CHIPS Act Has Already Sparked $450 Billion in Private Investments for U.S. Semiconductor Production, Semiconductor Industry Association (2024).

[9] Megha Mandavia, How China Could Swamp India’s Chip Ambitions, The Wall Street Journal (2024).

[10] FACT SHEET: President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices, The White House (2024).