2025 Analysis

| Assessment: U.S.-Lead | Confidence Interval: Low |

| Direction: Trend U.S. | Confidence Interval: Low |

________

China is Chasing U.S. Leadership in Synthetic Biology

While the United States leads in innovation and market value, China is narrowing the gap through concentrated state investment and leveraging its superior biomanufacturing capabilities. As of 2023, the U.S. synthetic biology market dwarfed China’s, with an estimated value of $16.35 billion[1] compared to China’s $1.05 billion.[2] The U.S. market is projected to reach $148.93 billion by 2033,[3] while China’s is expected to grow to $4.65 billion by 2030.[4] From 2008 through 2022, U.S. government funding for synthetic biology rose from $29 million to $161 million.[5] Since 2018, the PRC synthetic biology market has attracted 1,039 investment deals involving 456 synthetic biology-related companies, with disclosed total funding exceeding ¥92 billion ($12.7 billion).[6]

Biomanufacturing capacity is a key area of divergence. China dominates with 70% of global fermentation capacity, producing over 30 million tons of fermentation products annually,[7] while the United States holds just 34%.[8] This industrial-scale infrastructure enables China to commercialize synthetic biology innovations rapidly. In contrast, the United States faces bottlenecks in pilot-scale (~1,000L) and demonstration-scale (~20,000–75,000L) fermentation facilities, limiting startups’ ability to scale technologies.[9] The global precision fermentation capacity, essential for synthetic biology growth, needs to expand 20-fold,[10] highlighting the urgency of addressing U.S. infrastructure deficiencies.

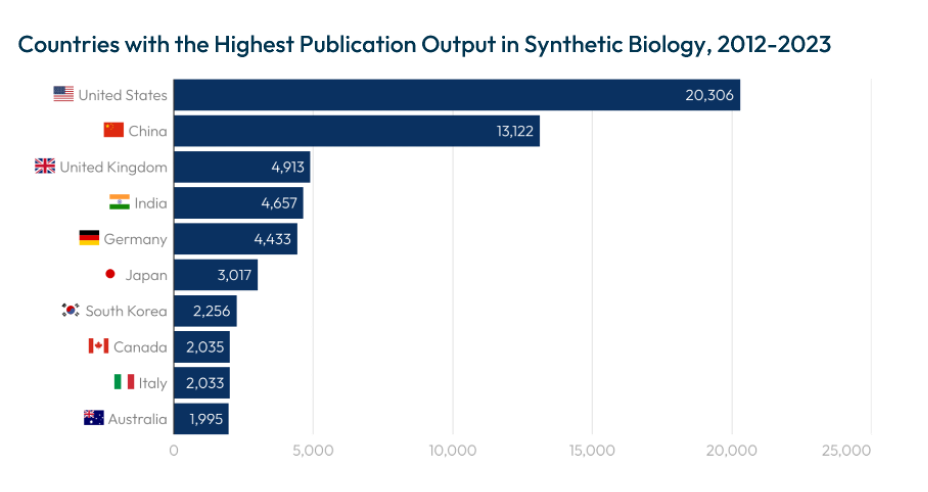

The United States remains a global leader in research and innovation. Between 2012 and 2023, it accounted for 33.6% of global synthetic biology publications, with 20,306 papers compared to China’s 13,122 (21.7%).[11] This leadership is exemplified by breakthroughs in CRISPR gene editing,[12] computational biology,[13] and synthetic genome design,[14] as seen in companies like Intellia Therapeutics advancing in vivo gene editing treatments.[15] However, China excels in translating research into commercial applications. It leads in patents, holding 49.1% (25,099 patents) of global synthetic biology patents, compared to the U.S.’s 12.8% (6,524 patents), demonstrating strong translation of research to intellectual property protection.[16]

Source: Literature Review of the Trends and Issues in Synthetic Biology (2012–2023), UN Environment Programme (2024).

China has built an extensive synthetic biology ecosystem[17] through institutions like the China National GeneBank[18] and the China National Center for Bioinformation. These platforms house millions of biological samples and provide advanced tools for data archiving and visualization. Internationally, China leverages the Belt and Road Initiative (BRI) to expand its influence in synthetic biology, forming partnerships in Asia and Africa.[19] This strategy enables China to gain access to genomic data and strengthen its position in global bioeconomies. China’s talent pipeline in synthetic biology is also strengthening. The country’s consistent success in the International Genetically Engineered Machine (iGEM) competition underscores its ability to cultivate a new generation of bioengineers. For instance, in 2024, the ShanghaiTech University team won a gold medal in the iGEM global finals, marking the institution’s eighth gold medal since its first participation in 2016.[20] This reflects China’s strategic focus on nurturing domestic expertise to support long-term competitiveness in synthetic biology.

Wildcards

- How Will Export Controls and Import Restrictions Reshape the Biotechnology Supply Chain? The competitive landscape is increasingly shaped by policy actions as both China and the United States consider restricting the export and import of sensitive biotechnologies. In December 2023, China added synthetic biology to its export control list, restricting technologies like CRISPR and gene editing for human use from export to foreign countries.[21] Previously proposed legislation like the BIOSECURE Act aimed to restrict U.S. research projects from using foreign adversaries’ biotechnology, particularly from China, such as PRC-origin DNA sequencers.[22]

- Will China Gain the Upper Hand in Emerging Biotechnology Markets? Such restrictions potentially reshape the global distribution of biotech supply chains, as China seeks to gain strategic access to genetic resources and strengthens its position in global bioeconomies.[23] BGI, China’s leading genomics organization, has engaged in global bio-prospecting through the BRI, establishing itself as a national champion in biotechnology.[24] In response, the United States has strengthened alliances with the European Union[25] and Japan[26] to enhance their collective biotechnology ecosystems. These partnerships aim to harmonize regulatory standards, promote joint research and development initiatives, and secure critical biomanufacturing infrastructure.

What to Watch

- AI Integration Accelerates Breakthroughs in Synthetic Biology Development. The integration of AI into synthetic biology is transforming the field. Collaborations like Ginkgo Bioworks’ partnership with Google Cloud to develop generative AI platforms demonstrate AI’s potential to accelerate R&D in drug discovery, agriculture, and biosecurity.[27] However, this convergence also amplifies risks. While today’s AI models and AI-enabled biological design tools are largely judged to not increase the risks of malign or misuse among non-expert users,[28] experts warn that AI tools could enable unskilled actors to create biological weapons within two to three years, heightening biosecurity concerns.[29]

- Global Competition for Biotechnology Leadership Intensifies Through Data Access. PRC companies have collaborated with the People’s Liberation Army in genomic research, highlighting the dual-use potential of such data. In response, the United States must prioritize initiatives to gather biological data and address data governance challenges to counteract China’s growing dominance in genomic data collection and utilization. Ensuring ethical standards and security measures in genomic data handling is crucial to maintaining competitiveness and safeguarding personal information.

[1] Synthetic Biology Market Size, Share, and Trends 2024 to 2034, Precedence Research (2024).

[2] China Synthetic Biology Market Analysis, Insights10 (2023).

[3] Synthetic Biology Market Size, Share, and Trends 2024 to 2034, Precedence Research (2024).

[4] China Synthetic Biology Market Analysis, Insights10 (2023).

[5] Synthetic/Engineering Biology: Issues for Congress, Congressional Research Service (2022).

[6] Wei Luo, et al., Synthetic Biology Industry in China: Current State and Future Prospects, (2023).

[7] Wei Luo, et al., Synthetic Biology Industry in China: Current State and Future Prospects, (2023).

[8] Europe Has Almost 50% of Global Protein Fermentation Capacity: Here’s How to Unleash Its Potential, GFI Europe (2023).

[9] Illinois Fermentation and Agriculture Biomanufacturing (iFAB) Hub: Overarching Narrative, U.S. Economic Development Administration (2023).

[10] Illinois Fermentation and Agriculture Biomanufacturing (iFAB) Hub: Overarching Narrative, U.S. Economic Development Administration (2023).

[11] Literature Review of the Trends and Issues in Synthetic Biology (2012–2023), UN Environment Programme (2024).

[12] Natalie Healey, Next-Generation CRISPR-Based Gene-Editing Therapies Tested in Clinical Trials, Nature Medicine (2024).

[13] Brianna Abbott, Nobel Prize in Chemistry Awarded to Trio Who Cracked the Code of Proteins, Wall Street Journal (2024).

[14] Synthetic Genomics Advances and Promise, J. Craig Venter Institute (2022).

[15] Natalie Healey, Next-Generation CRISPR-Based Gene-Editing Therapies Tested in Clinical Trials, Nature Medicine (2024).

[16] Literature Review of the Trends and Issues in Synthetic Biology (2012–2023), UN Environment Programme (2024).

[17] Antonio Regalado, China’s BGI Says It Can Sequence a Genome for Just $100, MIT Technology Review (2020).

[18] China National GeneBank Capable of Storing Millions of Biological Samples, Global Times (2024).

[19] Benjamin Plackett, Chinese Research Collaborations Shift to the Belt and Road, Nature (2024).

[20] ShanghaiTech Team Wins Gold Medal in the iGEM, ShanghaiTech University (2024).

[21] China’s Tighter Grip on Technology Export Restrictions and Licensing Procedures, KPMG (2024).

[22] BIOSECURE Act: Anticipated Movement, Key Provisions, and Likely Impact, Foley & Lardner LLP (2024).

[23] Key Milestones of China-Africa Cooperation Under BRI, CGTN (2024).

[24] Anna Puglisi, China’s Hybrid Economy: What to Do About BGI?, Center for Security and Emerging Technology (2024).

[25] U.S.-EU Synergy to Bolster Transatlantic Biotechnology and Biomanufacturing, National Security Commission on Emerging Biotechnology (2024).

[26] National Security Commission on Emerging Biotechnology Urges Department of State and Department of Commerce to Expedite Innovative Research Collaboration with Japan, National Security Commission on Biotechnology (2024).

[27] Ginkgo Bioworks and Google Cloud Partner to Build Next Generation AI Platform for Biological Engineering and Biosecurity, PR Newswire (2023).

[28] White Paper 3: Risks of AIxBio, National Security Commission on Emerging Biotechnology (2024).

[29] Testimony of Dario Amodei, Ph.D., Co-Founder and CEO, Anthropic, before the Judiciary Committee, Subcommittee on Privacy, Technology, and the Law, United States Senate, “Oversight of A.I.: Principles for Regulation” (2023).