In 2022, SCSP conducted a survey of 78 tech lists that outlined the current stated priorities of various government and non-government organizations in the United States, China, and around the world. From our analysis of the data, we published our “list of lists,” an aggregated estimate of modern technology priorities.[1]

To construct this report, SCSP revisited this analysis to conduct an updated survey of the current state of priorities in the U.S. innovation ecosystem. Our researchers identified 112 new tech lists from the United States, China, and foreign allies and partners published or updated since 2022. In this section, we use this updated data to analyze how stated technology priorities have changed over time, compare across our allies and adversaries, and differ between government and non-governmental actors.

Which Technologies Have Risen and Fallen in Mentions Since 2022?

- AI and advanced computing industries have grown in priority dramatically across all U.S. technology lists.AI and advanced computing technologies have long been a top focus, but, since 2022, they’ve grown to represent 24% of all technology priorities listed. Mentions of AI applications – to include explicit mentions of AI, autonomy, or “smart” technologies – have also grown from 12% in 2022 to 22% in 2024, in line with broader industry growth in generative AI innovations.

- Among advanced computing innovations, cloud/edge computing and quantum technologies are prominently mentioned. Although quantum innovations remain the most frequently mentioned advanced computing technology priority among the U.S. lists SCSP tracked, since 2022, these technologies have fallen from representing nearly 34% of computing priorities in 2022 to 29% in 2024. Across the same time period, cloud and edge computing technologies have nearly doubled from 10% in 2022 to nearly 19% in 2024.

- As a proxy for the broader biotechnology sector, health data has become a new priority in this latest survey of U.S. technology lists. AI diagnostics, pandemic tracking, and other innovations have risen from representing 12% of listed biotechnology priorities in 2022 to 27% in 2024. Interest in data-informed health innovation has risen notably in non-government lists.

- Advanced networks and autonomy/robotics, despite consistently being in the top five listed technologies in 2022, have declined in mentions. Since 2022, advanced networks has been mentioned as a priority on 57% fewer occasions across U.S. government and non-government lists. Similarly, autonomy/robotics has seen the second-largest decline in mentions out of any technology, mentioned 40% fewer times.

- Energy technologies have remained stable as a priority. Since 2022, energy technologies have consistently represented around 7-8% of all technology priorities listed. Within energy technologies, nuclear energy innovation, including fusion energy, has grown from representing 10% of energy priorities in 2022 to 17% in 2024.

- Cybersecurity, on the other hand, has shot up in interest. In 2022, cybersecurity innovations were mentioned in only 11 out of the 40 total U.S. technology lists. Since 2022, these same technologies have become a top five priority in both government and non-government organizations. Particularly, in government lists since 2022, mentions of cybersecurity technologies have doubled.

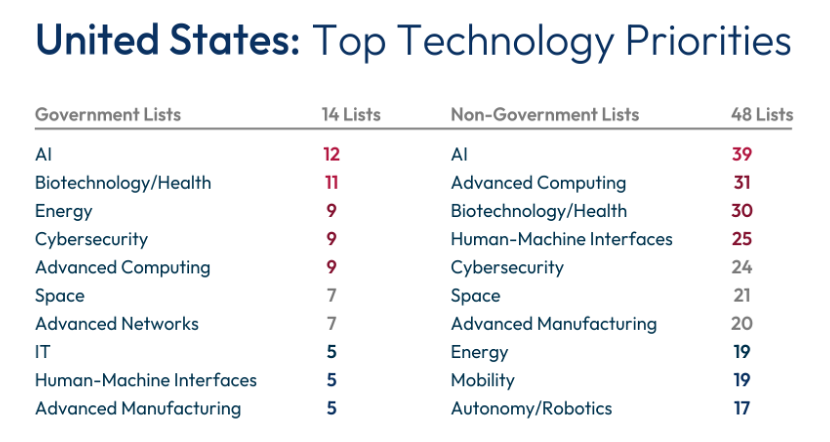

Which Technologies are U.S. Stakeholders Focusing On?

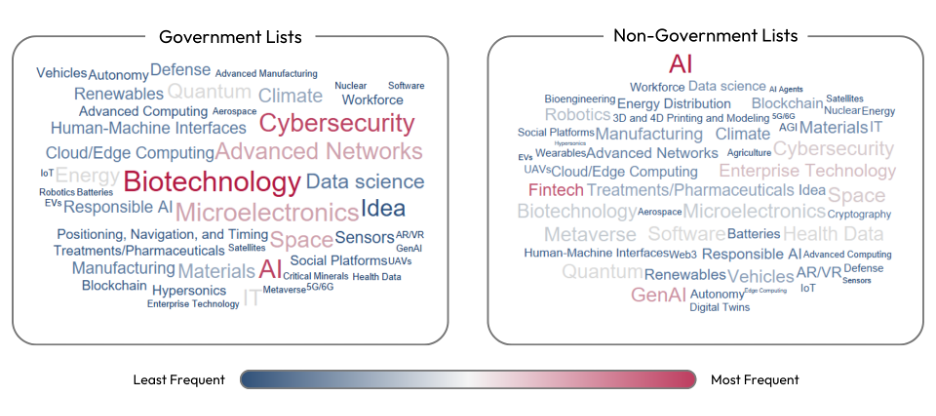

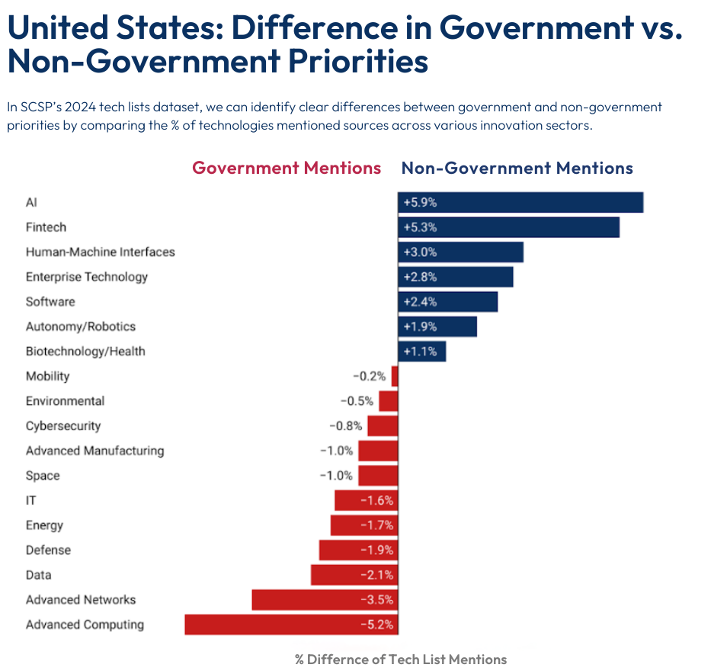

Within the U.S. innovation ecosystem, industry and government organizations tend to have dramatically different technology priorities. From our split analysis of government and non-government technology lists, we identify that non-government organizations tend to prioritize computing technologies – such as AI, human-machine interfaces, software – at much larger proportions than government lists. Comparatively, government organizations have prioritized more traditional, hard infrastructure technologies, such as advanced manufacturing, advanced networks, and advanced computing.

- Non-government U.S. stakeholders Are the Drivers of Mentions of Fintech, Software, and Enterprise Technologies. Out of the 14 government lists since 2022, these three technologies each represent less than 1% of the technologies mentioned. In fact, financial technologies are not mentioned once within government lists.

- U.S. Private Capital Investors Are Focused on AI, Fintech, and Biotechnologies. Out of the new 15 lists published by U.S. accelerators and investors since 2022, the top three technologies mentioned were in biotechnology/health, fintech, and AI. As one would expect, since ChatGPT’s launch in late-2022, AI’s prominence has grown, with 29% of industry listed technologies having explicit mention of AI, compared to 11% in 2022.

- U.S. Government Lists Have Focused on AI, Advanced Computing, and Advanced Networks, largely in line with Biden Administration priorities set out by policies including the 2022 CHIPS and Science Act, Executive Order 14110 on AI, and the National Artificial Intelligence R&D Strategic Plan.

[1] Our analysis breaks down each list by identifying the specific technologies mentioned and classifying them into different innovation categories. By counting how many lists each technology appears in, SCSP has crafted our “list of lists,” highlighting the most widely prioritized technologies across different organizations and sectors. Our analysis aims to use these lists as a geopolitical proxy to gauge how nations and innovation ecosystem stakeholders think about technology priorities and spot differences between the stated priorities of organizations across the innovation ecosystem. We have chosen to focus narrowly on publicly released technology lists as a novel signpost of stakeholder priorities though many other indicators exist, such as investment trends and R&D spending. This analysis builds on SCSP’s 2022 work, What’s in a Tech List?, Special Competitive Studies Project (2022).