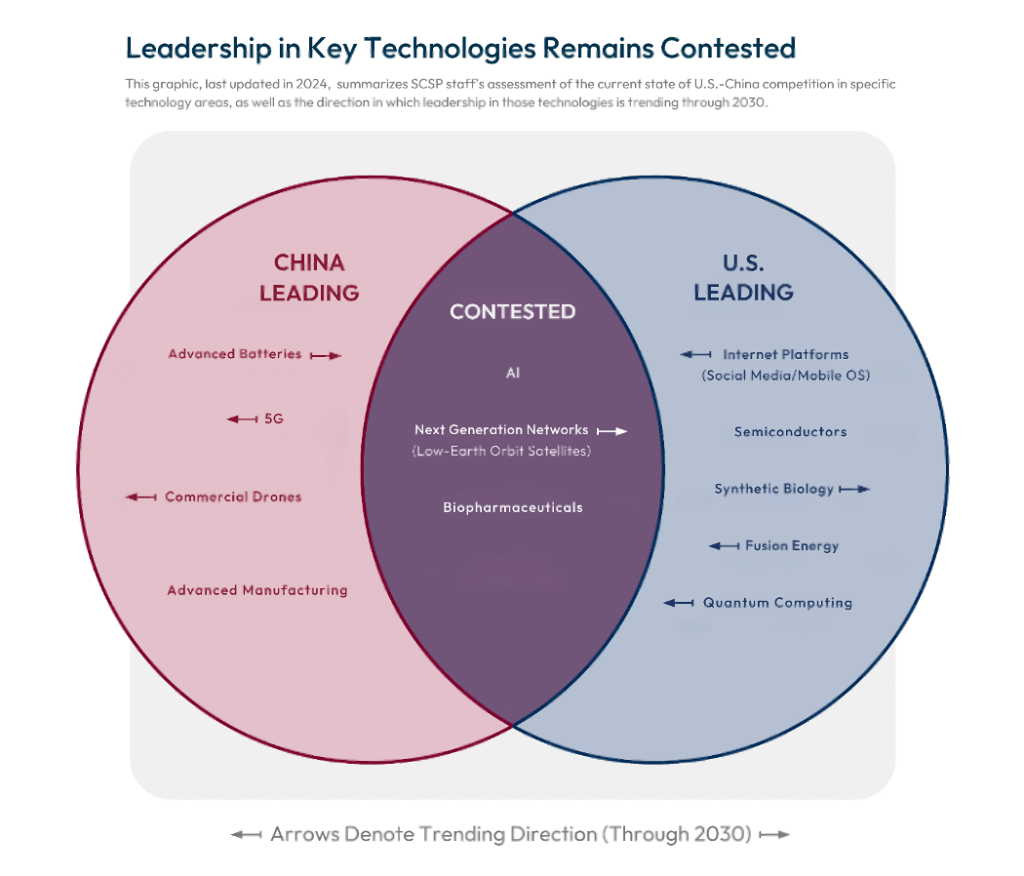

- China’s Dominance in Key Infrastructure: China’s sprawling manufacturing industrial base gives Beijing systemic advantages in capital-intensive sectors, such as advanced batteries and fifth-generation wireless networks (5G) infrastructure. Thanks to significant state investments, control over critical supply chains, and scalable manufacturing, China has daunting leads in these technology areas. Although the United States has made measurable progress in fielding some of these infrastructure-heavy technologies, supply chain gaps and bureaucratic red tape is hindering U.S. competitiveness.

- U.S. Leadership in Emerging Technologies: The United States maintains leadership in sectors such as artificial intelligence (AI), quantum computing, and synthetic biology, driven by strong private-sector ecosystems, global collaboration, and innovation in foundational technologies. However, China’s centralized funding and focus on commercialization are narrowing the gap in these areas.

- Divergence in Prioritization: Over the past three years, some U.S. industry stakeholders have shifted focus to AI, fintech, and human-machine interfaces, while some U.S. government departments and agencies continue to focus on advanced networks and advanced computing.

- Commercialization and Market Gaps: While the United States leads in innovation, China excels in commercialization across sectors such as biopharmaceuticals and synthetic biology, leveraging its superior production infrastructure, biomanufacturing capacity, and integrated ecosystems.

- Global Standards and Strategic Dependencies: The competition extends to influence over global standards (e.g., 6G, quantum technologies) and strategic dependencies in supply chains. U.S. reliance on international production, especially in semiconductors and biopharmaceuticals, highlights vulnerabilities that China could exploit through economic leverage or export restrictions.