Introduction

The modern world is vertically integrated on the transistor. A single leading-edge chip contains tens of billions of these tiny electronic switches, connected by roughly 60 miles of wiring – all in a form factor the size of a quarter.[1] The incredible technology trajectory of the integrated circuit (IC), from individual transistors soldered together by hand to the precise layering of billions of transistors at the nanoscale, has made possible technologies like personal computers, GPS, the Internet, and smartphones.[2] The power of these technologies are a testament to the exponential gains in compute attained over the past 75 years: an average iPhone contains more processing power than the entirety of the National Aeronautics and Space Administration (NASA) at the time of the Apollo 11 moon landing.[3]

Today, however, the fundamental processes that have enabled decades of progress in microelectronics are breaking down. Moore’s Law scaling has slowed and is projected to reach its limits within the next 15 years.[4] This trend has profound implications for the global economy and national defense:[5] continued technological progress in fields ranging from AI to biotechnology to materials science depends on the regular doublings in compute predicted by Moore’s Law.[6] The United States has long benefitted from its position as the global driver of innovation in advanced compute[7] and microelectronics, but continued leadership is not assured.

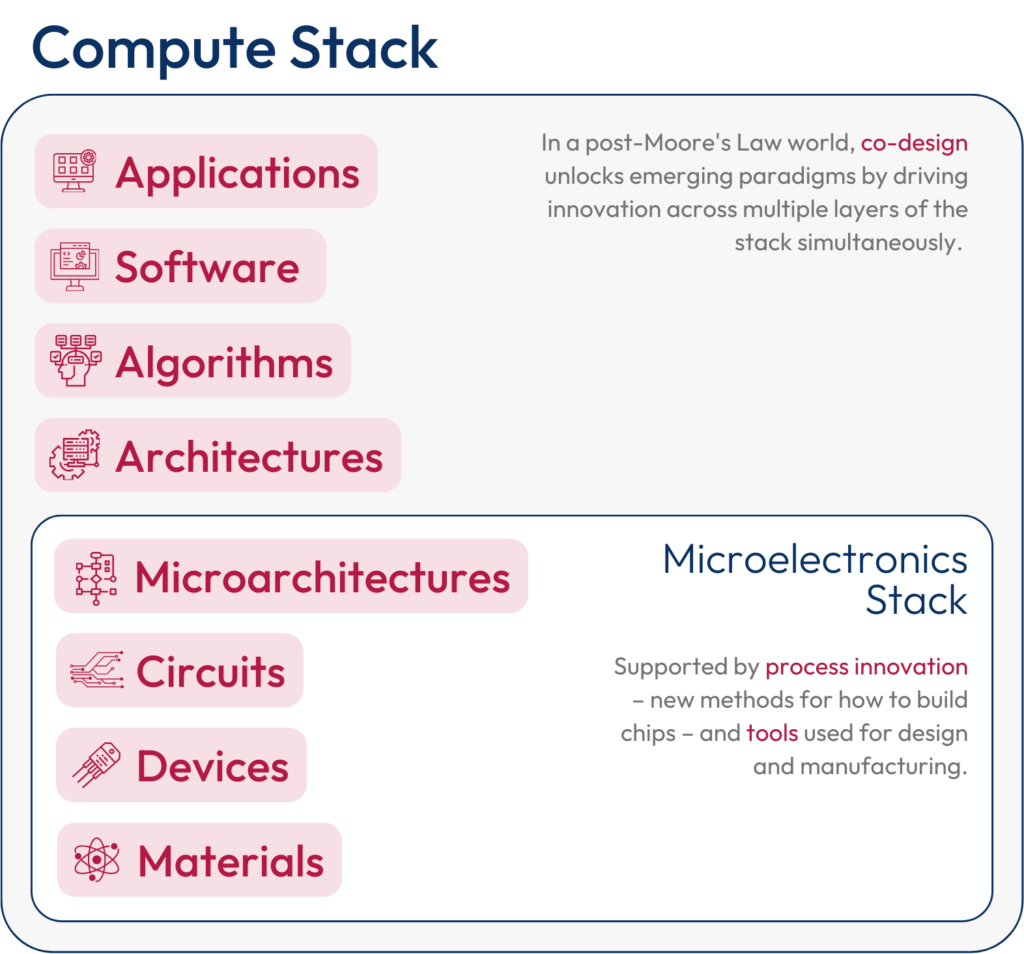

Compute and microelectronics consist of layers of enabling technologies. Taken together, these layers can be conceptualized as a single technology stack. The compute stack starts with materials: roughly half the elements in the periodic table have been used previously to build microelectronics.[8] Devices are tiny switches which correspond to 0s and 1s in digital computing. Circuitsstring devices together to perform compute functions. Architectures string components together to create a coherent, large-scale computing system. Algorithmsare sequences of instructions that the computer uses to solve a problem. The top layer, software, is the collection of instructions and programs that tell the computer what to do, while the applications layer serves as a bridge to solve real-world problems. Lower layers are supported by process innovation – new methods for how to build chips – and tools used to both design and manufacture them.

Ultimately, moving beyond Moore’s Law will require upgrading individual layers of the stack while testing fundamental assumptions about how computation takes place. Such a task demands a national effort to build, scale, and integrate emerging compute paradigms that employ novel materials, specialized hardware, and next-generation manufacturing techniques. Setting national ambitions for compute will drive progress in microelectronics and beyond. The nation that can successfully develop and deploy post-Moore’s Law compute paradigms at scale will gain the inside track during an era where computing power and AI capabilities underpin scientific and technological progress across all other fields.

Graphic Source.[9]

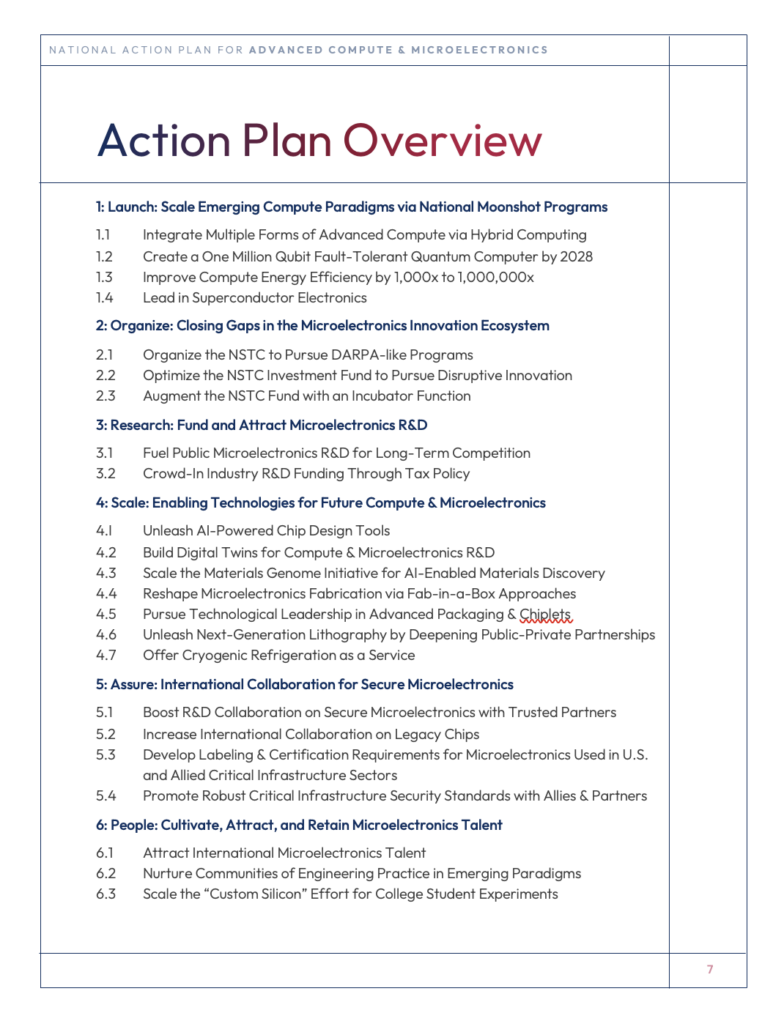

Many roadmaps detail the possible vectors for the future of compute and microelectronics.[10] Yet the current moment demands a concrete plan to ensure the nation is positioned and organized for leadership in the post-Moore’s Law era. This document does not directly address the need to build additional fabrication facilities or implement “protect” measures such as export controls (see Appendix A). Instead, it provides a forward-looking, technology-focused strategy for how academia, the private sector, and government can collaborate to ensure U.S. and global democratic leadership in this critical technology through 2030 and beyond. In doing so, it draws from the strategic logic of the Positioning School.[11] As SCSP writes in Harnessing the New Geometry of Innovation, “winning strategies take the form of dominant positions in the relevant competition…at the national level, the American democracy often secures strategic technology positions by national endeavors that translate latent power into active power.”[12] In the same way that the Apollo Program galvanized the nation to win the space race, bold national technology goals can propel the entire American innovation ecosystem into positions of national advantage.

Desired Endstate

The United States dominates the post-Moore’s Law future by bringing the world into the era of heterogeneous integration, scaling breakthroughs across the compute stack, and establishing positions of advantage in new forms of computing.

We envision a world where:

- Emerging compute paradigms are scaled and combined, enabling a step-change in AI performance;

- The United States drives advances in heterogeneous integration and advanced packaging which allow for continued scaling in computing power, at a rate that approximates Moore’s Law;

- Novel compute paradigms and microelectronics breakthroughs are developed and scaled which drastically reduce the energy demand associated with computation;

- The innovation pipeline for modeling and scaling emerging post-complementary metal-oxide-semiconductor (CMOS) devices and materials becomes more robust;

- AI-enabled design tools become widely diffused and are used to develop new forms of computing, significantly reducing barriers to entry;

- The United States, with its allies and partners, addresses hardware security risks with policy moves and technology solutions while countering Beijing’s efforts to disrupt the global chip industry, minimizing impacts on critical infrastructure and U.S. and allied firms;

- Technology breakthroughs significantly reduce the cost of microelectronics fabrication. Such breakthroughs could begin to reverse industry concentration and would be in the interest of the United States and its allies and partners.

Central Policy

Chart a post-Moore’s Law future by catalyzing disruptive innovation via compute moonshots and build a flourishing atoms-to-architectures innovation pipeline that can develop, scale, and integrate novel materials and devices.[13] In parallel, make key supporting moves to address enabling factors that make future U.S. and democratic leadership possible.

Background

American inventors Jack Kilby and Robert Noyce separately invented the integrated circuit over the span of a few months between 1958 and 1959.[14] Their designs took transistors – tiny switches corresponding to the 0s and 1s that power digital computers – and pieced them together on a small, flat semiconductor “chip.” In 1965, Intel co-founder Gordon Moore made a monumental prediction about the trajectory of the technology, which later became known as Moore’s Law. Moore observed that the number of transistors on a chip was doubling regularly, and he projected this trend would continue for the foreseeable future.[15] For the next 55 years, the development of microelectronics and corresponding increases in computing power followed the trajectory of Moore’s Law.[16]

Today, however, the trajectory of Moore’s Law is uncertain as transistor “scaling” bumps up against the limits of physics.[17] Transistor scaling already hit its first insurmountable obstacle in the early 2000s, when transistors shrank to such a degree that it became impossible to process information faster without overheating the chip.[18] In response, firms rolled out multi-core processing units that performed many computations in parallel.[19] This innovation, sometimes called parallel computing, allowed industry to keep pace with Moore’s Law in terms of performance – and helped power the deep learning revolution in AI over the past decade.[20] But parallel computing also decoupled the long-established link between Moore’s Law scaling and gains in energy efficiency.[21] Energy demand from compute has steadily grown to the point that it now consumes an estimated five percent of the world’s generated electricity.[22]

Beyond energy challenges, driving transistors smaller and smaller has resulted in new levels of complexity, squeezing firms on both technology and economics.[23] Pushing deep into the nanoscale has come with a price tag: since the world’s first 3D transistor debuted in 2011, research and development (R&D) costs have risen by roughly a factor of ten.[24] In the coming years, designing a 2 nanometer (nm) chip is projected to cost an estimated $725 million.[25] Building a chip fab for 2nm chips, meanwhile, could cost upwards of $30 billion.[26] With costs showing no signs of slowing down, something has to give.

Geopolitical Context

For decades, the People’s Republic of China (PRC) has set its sights on building a domestic microelectronics industry. China’s chip industry has received over $200 billion in government support over the past two decades as a prime target in Beijing’s push for “indigenous innovation.”[27] Though the industry as a whole is still emerging (China has imported more semiconductors by value than any other product, including oil, for several years in a row),[28] individual firms have begun to break through, with several launching internationally competitive products.[29] China’s microelectronics industry benefits from access to virtually unlimited resources, a massive (and protected) domestic market, a growing and highly motivated pool of scientists and engineers, and an industrial espionage strategy with global reach.[30] Counting it out would be a mistake.

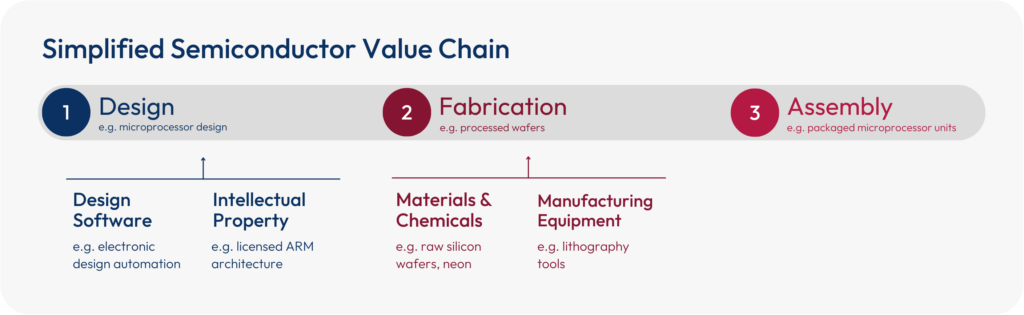

Graphic Source.[31]

Over the past five years, U.S. policymakers have recognized the geopolitical importance of microelectronics and their position as a key technology battleground.[32] The Trump Administration imposed export controls on certain high-end chips to PRC-champion Huawei and blocked Beijing’s attempts to acquire U.S.-headquartered chip firms Qualcomm and Micron.[33] In 2022, U.S. policy efforts reached a new peak with passage of the CHIPS & Science Act, landmark legislation which included $39 billion in manufacturing incentives across the microelectronics value chain and $11 billion for microelectronics R&D. The R&D program included funding for a National Semiconductor Technology Center (NSTC) to serve as a national innovation hub for the microelectronics ecosystem, as well as a National Advanced Packaging Manufacturing Program (NAPMP).[34] The Biden Administration also placed export controls on advanced chips for AI training and semiconductor manufacturing equipment, dealing a blow to Beijing’s microelectronics industry.[35]

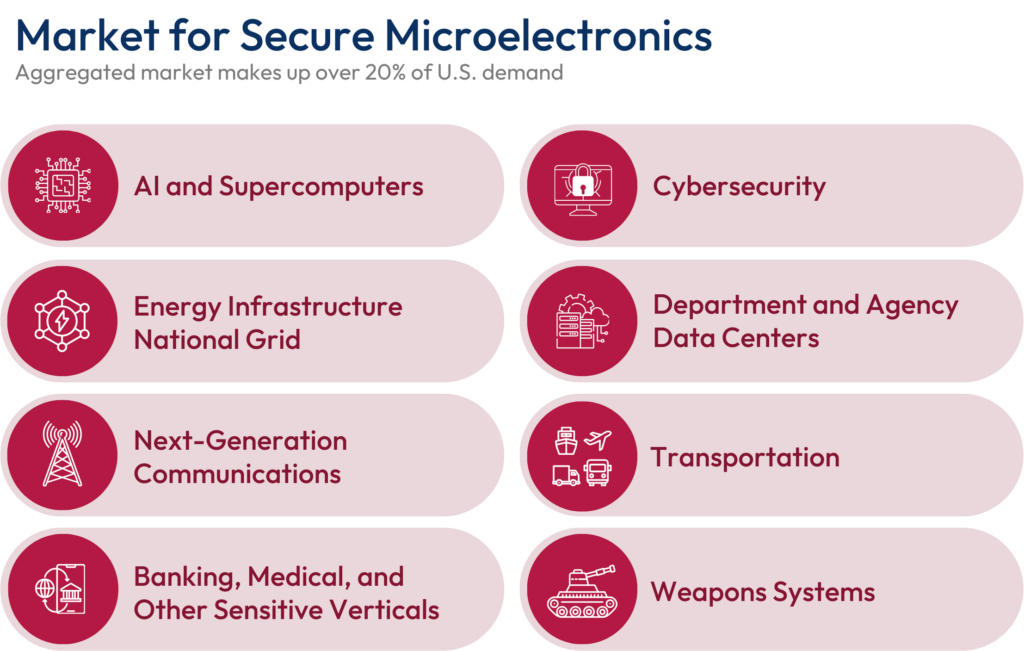

Despite these efforts, risk vectors stemming from microelectronics still pose a threat to the national security and economic competitiveness of the United States and its allies and partners. PRC semiconductor producers are planning a massive buildout for lagging-edge chip nodes over the next five years, increasing their capacity by nearly as much as the rest of the world combined.[36] This buildout poses severe challenges not only for the competitiveness of U.S. and allied firms, but also for information security and privacy. Currently, there are few restrictions to block or screen these chips, which may contain vulnerabilities and backdoors, from being deployed in critical infrastructure sectors.[37]

In the coming years, cybersecurity at the hardware layer is likely to emerge as a key challenge due to the efforts of both nation-state and nonstate actors.[38] A range of mechanisms have emerged that allow malicious actors to insert vulnerabilities – which could function either as an “on-off switch” or as a backdoor for data exfiltration – directly into a chip’s hardware or firmware. In addition, side-channel and fault-injection attacks allow for chips to be targeted in the field.[39] These attacks typically cannot be patched immediately like software vulnerabilities. Technology trends towards heterogeneous integration (see below), where multiple “chiplets” from a range of third-party designers and foundries are combined to form a single system-in-package, will exacerbate these risks.[40]

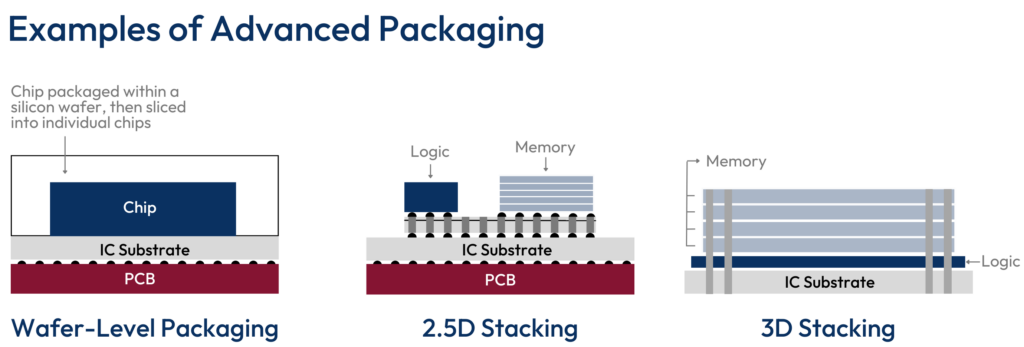

Science & Engineering Beyond Moore’s Law

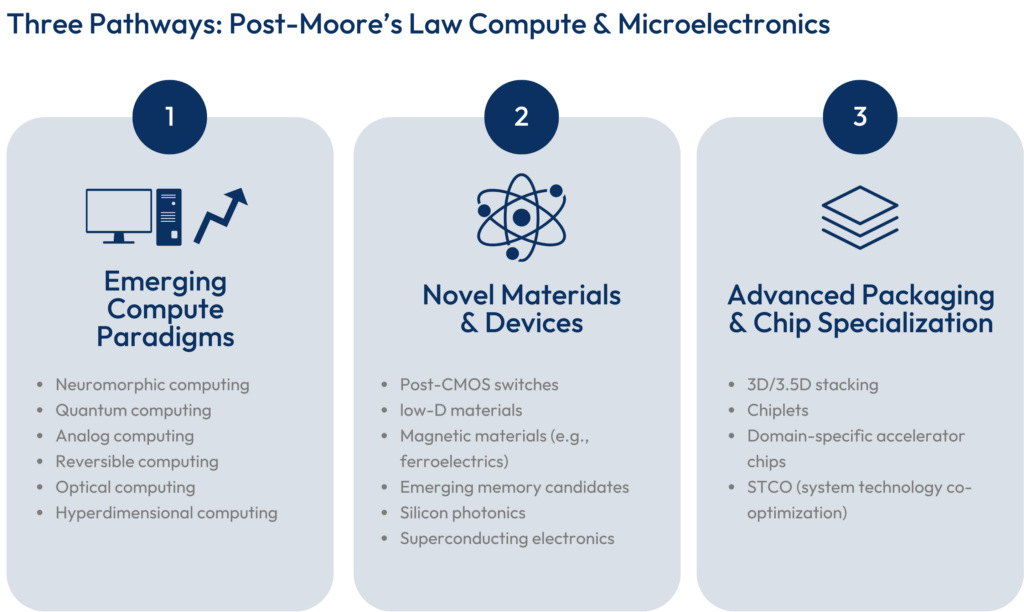

Ultimately, there are three fundamental pathways to innovating beyond transistor scaling.[41] The first approach involves a combination of 3D heterogeneous integration and specialized chip architectures. The former owes inspiration to Gordon Moore himself. In his seminal 1965 paper, Moore proposed that, instead of continuing to shrink transistors and cram them onto flat silicon wafers, continuing performance gains would require scaling chips vertically.[42] Today, this approach involves combining and connecting components vertically to form complex 3D microsystems.[43] The latter prong of this approach involves building specialized “accelerator” chips for particular applications, as these offer efficiencies and performance gains over their general-purpose counterparts. While these approaches offer a clear next step for microelectronics, they are subject to significant challenges and should not be the only approach the nation relies on.[44]

Second, novel materials and devices add new functionalities to key layers of the computing stack. A range of materials are emerging that promise significant improvements in energy efficiency. Novel post-CMOS device candidates are also emerging which harness different state variables – beyond the flow of electrons in traditional electronics – to perform calculations and store data. Photonics, for example, harnesses the power of light to transmit data from place to place,[45] while spintronics and ferroelectrics use unique properties of magnetic fields and electron spin to perform computation. Advances in these fields are essential and will be necessary to continue transistor scaling beyond 2030.

In the long run, supplying ever-increasing compute demand will require revolutionary, not evolutionary, advances in post-Moore’s Law paradigms.[46] Novel compute paradigms are emerging that require us to fundamentally reimagine how computation takes place.[47] To take one example, neuromorphic computing unlocks a new approach to compute based on the neural architecture of the human brain, allowing chips to operate at ultra-low power and potentially enabling new approaches to AI. Quantum computing, meanwhile, harnesses the power of the atom as a processor to solve problems that classical computers cannot. These new paradigms are typically built on novel hardware combinations and often require the creation of an entirely new software stack, but offer the greatest long-term promise to drive continued compute scaling. As such, they are prime targets for government de-risking efforts.

Tech Trends Driving Compute Demand

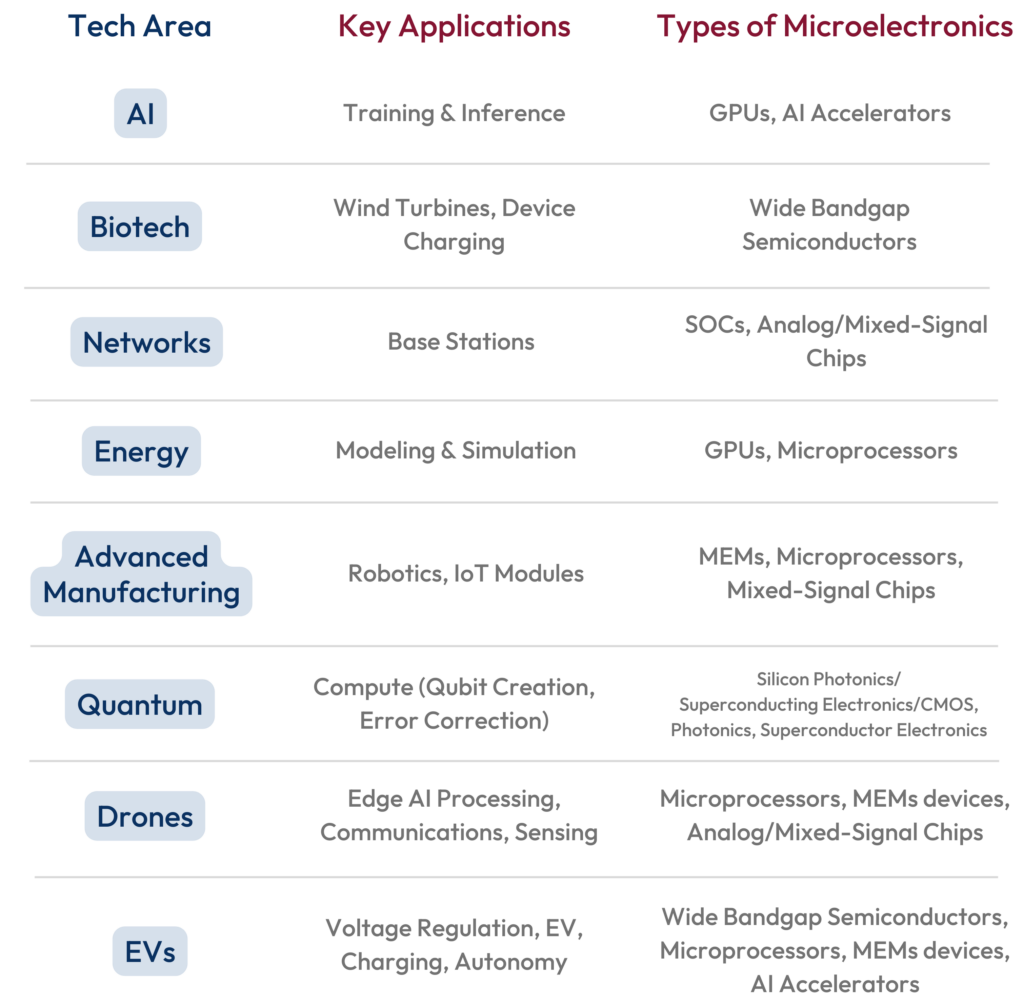

Tomorrow’s technology trends are driving the demand side for new forms of compute. Simply put, microelectronics are being asked to do things they have never had to do before. As we continue to move away from the general-purpose era where microprocessors powered everything from desktops to supercomputers, new applications across multiple tech areas will demand new, specialized computing capabilities. We can already see a number of these vectors on the horizon.

AI: Bigger, Better, and Everywhere. Generative AI (GenAI) is driving a flywheel of convergence, innovation, strategy, and advancements across the tech stack that will ultimately lead to a more general form of AI.[48] Over the next 10 to 15 years, AI will likely become both more ubiquitous and much, much more powerful. We can expect AI models to emerge in many shapes and sizes: small-scale systems will arrive that are capable of “learning” locally, instead of needing to communicate with the cloud.

Post-Exascale High-Performance Computing. Over the past 15 years, the U.S. government has successfully pushed compute into the exascale era.[49] Over the next 10 to 15 years, nation-state actors will target supercomputers that reach the zettascale, and we may see the emergence of large-scale quantum systems.[50] These massive supercomputers could model fusion reactions, accelerate advanced materials discovery, and manage a highly distributed energy grid. By 2037, such a system may be capable of training a 500 trillion parameter AI model in a week.[51] Next-generation supercomputers could also be hybrid systems that blend multiple compute paradigms.[52]

6G & the Internet of Things: Pervasive Interoperable Connectivity. 6G is poised to accelerate the convergence of bits and atoms at the edge. We may see the mass deployment of Internet of Things (IoT) devices that are ubiquitous throughout the built environment, as well as deployment of devices compatible with the natural environment.[53] Broad adoption of extended reality systems would deepen the blending of the physical and digital worlds. Mass deployment of edge devices will demand novel hardware solutions, like low-power analog AI accelerators, that are several orders of magnitude more energy efficient than today’s processors.

Electrification and Autonomy: Automotive & Advanced Energy. Power semiconductors are necessary for a range of advanced energy technologies, from electric vehicles (EVs) to grid transformers, all of which need to significantly scale to meet growing global demands. For example, building autonomous vehicles (AVs) and EVs requires the creation of a “portable data center on wheels.”[54] Fusing data from thousands of sensors to form a coherent world model, AVs and EVs must apply enough compute power to run AI models that make snap decisions faster than a human can react.[55]

First Principles

- Moore’s “Day of Reckoning” Has Arrived. As transistor scaling slows, we have entered uncharted territory. Continued technological progress demands continued increases in computing power that approximate Moore’s Law.

- Compute Moonshots Require a “Co-Design” Mindset. Moonshot programs can unlock emerging compute paradigms, broadening the range of problems that humanity can solve. But getting there means solving technical problems that span different layers of the compute stack, from exotic devices and materials to software and algorithms.[56]

- Breakthroughs in Microelectronics Take Time – and Government De-Risking – to Commercialize. In the chip industry, new breakthroughs take 10 to 20 years, on average, to reach commercialization.[57] Government support through R&D funders like the Defense Advanced Research Projects Agency (DARPA) has been a central factor throughout the tech history of Moore’s Law.[58]

- Tools Are Positions That the Nation Must Occupy. Design and fabrication tools are crucial enabling technologies for compute and microelectronics. Leadership in these complex technologies is a vital form of national advantage.

- Hardware Security Matters. Chips and other forms of electronic hardware are increasingly vulnerable to attack, including via backdoors embedded during the design and fabrication process.[59] The PRC’s position as a leading global electronics producer plus intensifying geopolitical tensions are combining to create new vectors of national cybersecurity risk.[60]

- Legacy Chips Will Remain a Competition Conundrum. Chips in the 28nm to 180nm range power America’s critical infrastructure, cars, robotics, smart manufacturing, defense platforms, and smart agriculture.[61] Beijing’s massive capacity buildout means America and its allies and partners risk becoming even more dependent on the PRC in these sectors, unless legacy-node supply becomes a priority for the United States and like-minded countries.[62]

- Microelectronics Are a Key Enabling Technology for All Battleground Sectors. U.S. and allied competitiveness in AI, advanced networks, biotechnology, energy generation and storage, and convergence technologies like advanced manufacturing, drones, and EVs hinge on sustaining microelectronics innovation and growing compute power.

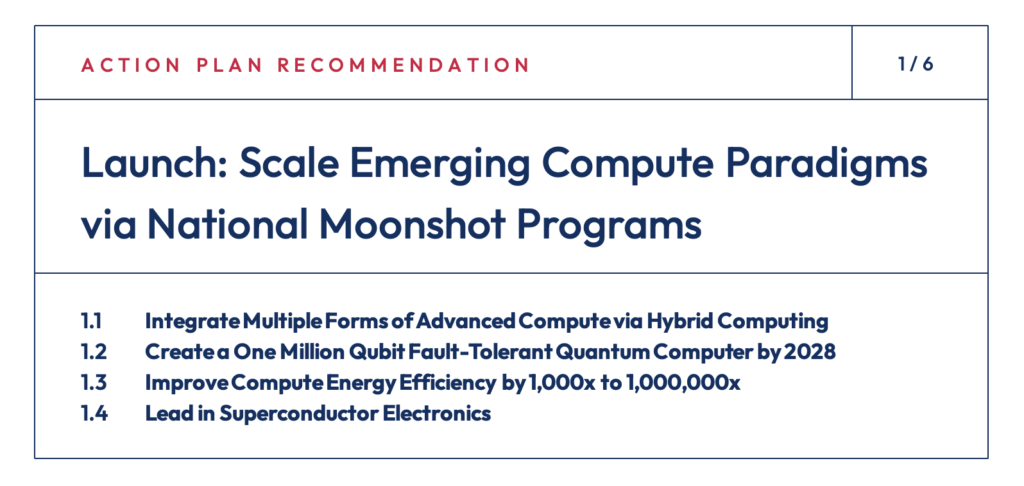

Moonshots are audacious goals that can move the entire U.S. innovation ecosystem toward a position of competitive advantage. These proposed goals are beyond “hard,” but like the Apollo Program they are attainable through a whole-of-ecosystem effort.[63] As the microelectronics industry approaches the end of Moore’s Law, the United States needs an Apollo-like effort dedicated to scaling and seamless integration of emerging compute paradigms. Such an approach would fulfill the vision of the 2017 Report to the President on Ensuring Long-Term U.S. Leadership in Semiconductors, which called for a ‘leapfrog’ strategy in compute and microelectronics to retain American competitiveness.[64] The CHIPS R&D program funded by the CHIPS & Science Act offers the nation an unprecedented opportunity to launch such programs.

What sets moonshots apart from more incremental approaches to technological progress? First, by aiming to achieve a step-change or paradigm shift, such programs drive the rest of the innovation ecosystem toward a vision of national advantage. Second, properly-designed moonshots promote accountability by assigning a National Mission Manager to own the program full-time. And third, moonshots aim to create a tangible platform – a capability – that solves an especially hard problem and creates many second-order benefits for the economy. The correct number and type of moonshots are ultimately determined through technology and competitive strategy arguments.[65]

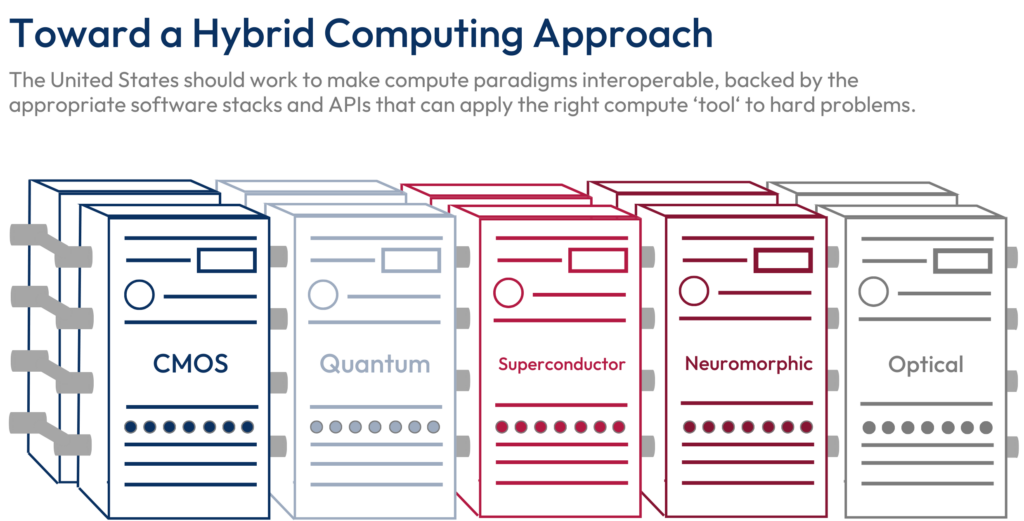

1.1 Integrate Multiple Forms of Compute Via Hybrid Computing

The nation that creates integration among emerging compute paradigms will have a dominant advantage exiting this decade. As new forms of compute emerge as viable paths forward, the nation that scales multiple forms of compute and develops a method to make them seamlessly interoperable – both with CMOS and with each other – will be best positioned for a post-Moore’s Law world.[66] The overarching aim, therefore, should be a hybrid computing strategy that combines these modalities through a general-purpose CMOS ‘user interface.’ The result would be the ability to combine the strengths of each compute architecture in an interoperable way for applications like AI. Such an approach could enable supercomputing beyond exascale, sustainable AI in hyperscale data centers, and other demanding applications.

Objective: Create hybrid computing architectures that are seamlessly interoperable, addressing the complexity of extreme heterogeneous computing environments that are emerging to address challenging problems with incalculable societal impact. For example, such a system could integrate AI outputs across multiple compute paradigms, from conventional high-power CMOS to emerging compute paradigms based on novel hardware.

Method: Charge a National Mission Manager at the Department of Energy (DOE), NSTC, or an alternative responsible organization to create an integrated computer architecture that combines all three categories of computer for a national security application. Employ a co-design approach to create integrated hardware, firmware, and software to bring appropriate forms of compute to bear on various AI problem sets. In addition to creating a novel integrated hardware and software stack, develop a family of AI applications (or “system of systems”) with an application programming interface (API) gateway approach for specific computationally intensive national security applications. The chosen application could involve open-source intelligence fusion, modeling and simulation of national security scenarios, or military command and control recommendation agents. The resulting architecture would take the advantages of each form of compute and apply the AI sidecar best suited for the task.

1.2 Create a One Million Qubit Fault-Tolerant Quantum Computer by 2028

Quantum information science (QIS) has become like an economic sector unto itself.[67] Harnessing the power of the atom as a processor, quantum computing can offer a step-change in our ability to tackle compute-intensive tasks like advanced modeling.[68] For quantum computing, the remaining technical hurdles are not trivial, and include sensitivity to interference (error rates),[69] scaling challenges,[70] and unresolved interoperability challenges.[71] Commercial quantum computing R&D has spurred multiple startups and significant private investment in recent years, yet lengthy commercialization timelines, steep technical hurdles, a lack of proven use cases, and a volatile federal funding environment risk the onset of a “quantum winter” just as rival ecosystems double down on achieving large-scale systems.

Objective: Develop a one million qubit fault-tolerant computer with interconnect output to CMOS (potentially via a cloud accessible quantum hub) by 2028.

Method: The U.S. government should support a renewed National Quantum Initiative, including elevating it to the Office of the Vice President and naming a National Mission Manager as a direct report to the Vice President who will develop a strategy for the breakout and commercialization of quantum computing this decade, and providing necessary funding to the initiative. The initiative could update the 2018 national quantum strategy and should focus on identifying opportunities to scale public-private partnerships that provide startups access to enabling technologies like cryogenic refrigeration, as well as developing action plans for delivering on the stated quantum objectives between the United States and its allies and partners.[72] An updated strategy should also address the need to produce scalable quantum microelectronics domestically and secure other elements of the supply chain for quantum computing components.

1.3 Improve Compute Energy Efficiency by 1,000x to 1,000,000x

Since the mid-2000s, scaling in compute energy efficiency has slowed significantly.[73] This poses a major challenge at a time when AI workloads are rapidly accelerating compute demand: if current trends continue, energy demand from compute could exceed global energy generation by 2040.[74] Novel materials, devices, and architectures are needed to dramatically reduce energy consumption, and novel compute paradigms could make the most significant difference in the long term. Reversible computing, for instance, could alleviate this problem by harvesting energy that would otherwise be lost as heat, allowing for computations to occur below thermal limits of conventional hardware, and perhaps eventually below the Landauer Limit – the ultimate limit to scaling energy efficiency.[75]

Objective: Reduce energy consumption by 1,000x within 10 years while targeting a 1,000,000x reduction by 2040.[76]

Method: Launch a national moonshot program led jointly by the DOE’s Advanced Manufacturing office (AMO) and Office of Science, which have already established major research programs for the future of microelectronics, with involvement from the NSTC and relevant national labs.[77] Such a program should pursue a range of compute paradigms and relevant materials, devices, and architectures.[78] In particular, the program should focus on scaling for reversible computing by tackling core problems across the stack like developing novel algorithms, cell libraries, electronic design automation (EDA) tools, and fabrication techniques.[79] [80]

1.4 Lead in Superconductor Electronics

Superconductor electronics leverage the unique quantum properties of superconducting loops and switching devices called Josephson junctions to create extremely fast, energy-efficient circuits with zero electrical resistance.[81] Superconductor electronics accelerate classical computing, and also enable promising new approaches to neuromorphic computing, quantum computing, and reversible computing.[82] All told, this hardware paradigm carries the potential to unlock new forms of AI far surpassing present capabilities.[83] Recent breakthroughs in device density, memory elements, and design tools for superconductor electronics suggest that the technology may be approaching commercial readiness.[84]

Objective: Position the United States to lead the scaling of superconductor electronics by 2030, with a long-term goal of using these circuits in large-scale hybrid computing systems.

Method: Identify a National Mission Manager at the NSTC, DOE, or an alternative responsible organization responsible for taking key actions to scale superconductor electronics. Key moves should include:

- Opening a commercial-scale, 300mm wafer production line for superconductor electronics on American soil by 2030;

- Funding a national program that aims to interface superconductor electronics with photonics and CMOS to build a large-scale supercomputer.[85] Such hardware is uniquely conducive to large-scale computational systems leveraging digital, neural, and quantum principles;

- Increasing R&D efforts in superconductor neuromorphic architectures. Such a program should draw from biological systems, with an end goal of developing a new approach to AI capable of continuous learning;[86] and

- Developing a strategy with National Science Foundation (NSF), DOE, and the National Institute of Standards and Technology (NIST) to train 1,000 engineers in superconductor electronics by 2030, with a goal of unleashing innovation.[87]

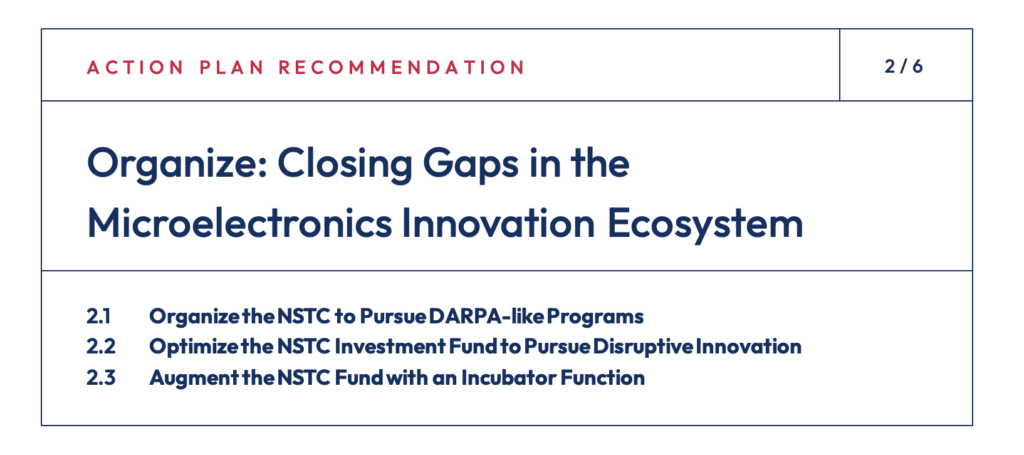

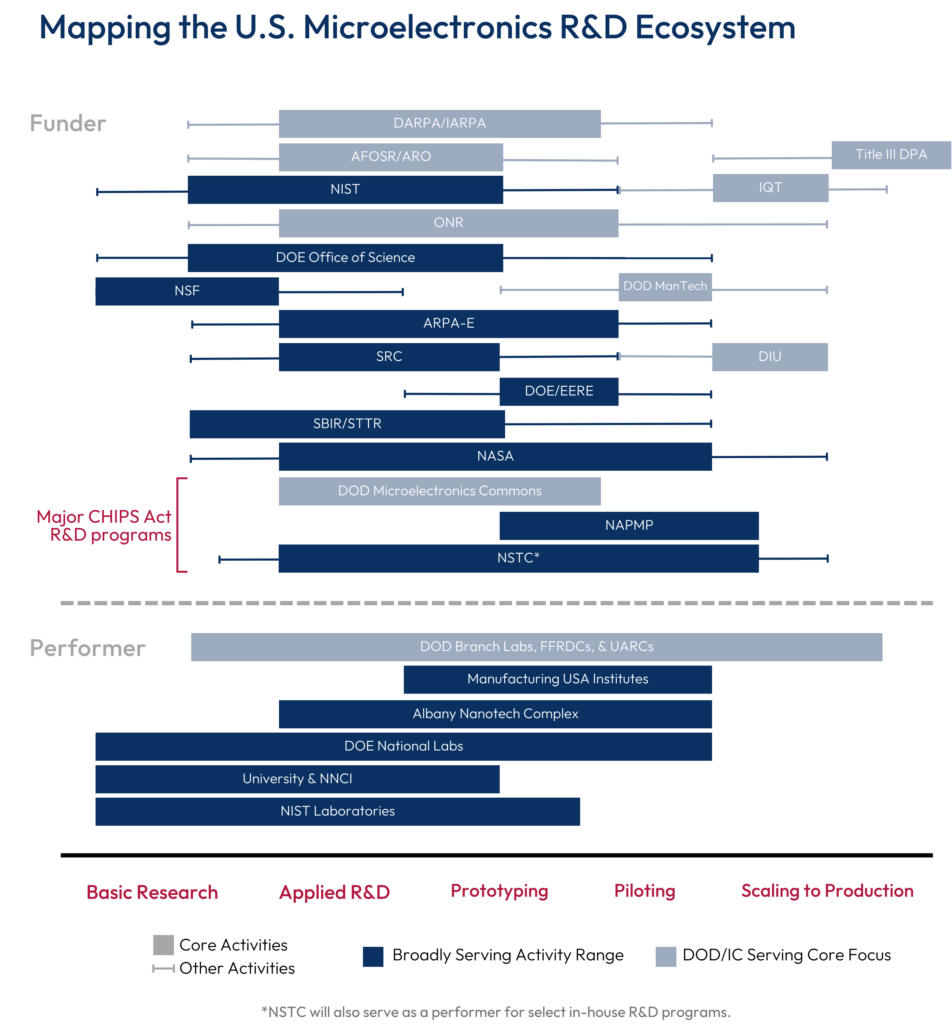

By all accounts, the United States enjoys the world’s most vibrant innovation ecosystem for compute and microelectronics. This ecosystem is anchored by research programs at several hundred colleges and universities,[88] many of which are funded by government players – including the NSF, DARPA, and the National Nanotechnology Initiative – and industry players such as the Semiconductor Research Corporation.[89] The Department of Defense (DoD), via DARPA, has historically played an outsized role in driving the future of microelectronics systems.[90] But the contemporary challenge has grown to transcend its DoD origins. At the same time, the innovation ecosystem has grown more decentralized as key hubs in the ecosystem – including MOSIS and SEMATECH – have retreated or dissolved, leaving university and government labs to pursue their research agendas with minimal national direction or scaffolding to translate innovation to commercial scale.[91] Meanwhile, industry players have pulled back long-term R&D efforts in favor of near-term process nodes as competitive pressures mount.[92]

With the passage of the CHIPS & Science Act, the microelectronics R&D ecosystem has received a much-needed jolt. The National Microelectronics R&D Strategy is a positive step toward a coordinated, national approach to semiconductor R&D,[93] while new institutions like the NSTC, NAPMP, and DoD Microelectronics Commons will create additional capacity for prototyping – a major boon to researchers and innovators who often lack access.[94] Yet this organizational scaffolding is unlikely to be able to rise to the role of a NASA for microelectronics unless several significant gaps are filled: 1) a dedicated hub for compute and microelectronics moonshots; 2) a large investment fund, as authorized by the CHIPS Act; and 3) robust mechanisms to convene the private sector in pursuit of national priorities.

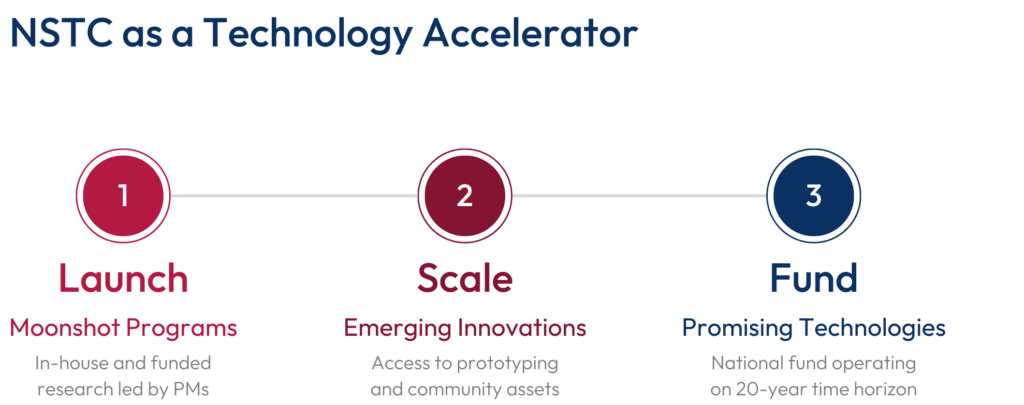

2.1 Organize the NSTC to Pursue DARPA-like Programs

The NSTC has been tasked by Congress and the Executive Branch with ensuring U.S. technological leadership in microelectronics over a 20-year time horizon.[95] Thus far, initial implementation focus has focused on offering access to prototyping capacity; providing community resources, such as access to design tools; and administering workforce development programs.[96] These initiatives address significant gaps in the innovation ecosystem. Access to prototyping in particular has been correctly identified as the core challenge to scaling microelectronics innovation in the United States.[97]

To guide this new organization, the Department of Commerce (DOC) has established an eminently qualified Industrial Advisory Committee (IAC) to guide CHIPS Act implementation.[98] Yet, in order to act as the nation’s premier research entity, the NSTC must also have the capacity and mandate to plan and execute future-oriented, national-level moonshot programs, in partnership with the private sector and other government entities. Spurring step-changes in compute and microelectronics, enabled by deep co-design, will require a DARPA-like approach backed by sufficient organization and resourcing.

Objective: Ensure the NSTC is positioned and organized to ensure U.S. technological leadership in compute and microelectronics over a 20-year time horizon by executing national, bar-setting programs.

Method: Structural characteristics that would allow NSTC to achieve these objectives include the following:

- Strong Central Hub. If the NSTC is to successfully pursue its research agenda and convene key players across the microelectronics ecosystem, it must be anchored by a strong central hub and connected to Centers of Excellence and prototyping facilities on the periphery.[99] The organizational hub could be split between several separate facilities to cover the full gamut of technologies emerging across the stack.

- Independent Technical Staff Augmented by Detailed Staff. Combining characteristics of imec and DARPA, the NSTC should have an in-house, independent technical staff to support Program Managers. Bringing in short-term industry and university detailees can support workforce training and facilitate tech transfer.

- Shielding From External Pressures. Historically, DARPA has been allowed to pursue its research agenda free from external pressures – an underrated key to its success.[100] NSTC must be afforded similar freedom to set its research agenda.

- Ability to Partner with Other Government R&D Programs. NSTC should not be limited to performing its own research. Instead, the organization can serve as a force multiplier that scales promising research programs through funding and convening.

2.2 Optimize the NSTC Investment Fund to Pursue Disruptive Innovation

The CHIPS & Science Act authorized the NSTC to launch an investment fund that, if implemented effectively, can provide patient capital to scale transformative innovations from across the compute stack. Entrepreneurs working on disruptive technologies in the microelectronics space face daunting challenges, including very high initial costs compared to other industries and an understandable reluctance among many venture capital (VC) firms to invest in hardware technologies with a consolidated market and an uncertain timeline to commercialization.[101] Since bets by even the most accomplished VC funds fail far more often than they succeed, an NSTC fund demands a higher-than-typical tolerance for uncertainty and risk.[102]

Objective: Launch a sufficiently resourced NSTC fund, potentially via an external partner, focused on de-risking seed and early-stage startups aiming to bring disruptive technologies from across the compute stack to market.

Method: Adopt best practices from notable deep tech investment funds, such as In-Q-Tel (IQT) and The Engine, as well as impact investing principles.[103] The fund should be shaped according to the following characteristics:

- Focus on Seed- and Early-Stage Investments. The most significant funding gap for disruptive technologies across the microelectronics stack exists earlier in the startup lifecycle. Investing early would unlock additional investment and encourage established funds to invest.[104]

- Robust Due Diligence and Professional Fund Management. Ensure professional and experienced private sector-based fund management and due diligence capabilities to optimize the quality and effectiveness of capital deployments, including through private sector matching. To ensure objectives are being met, incorporate necessary but streamlined monitoring, measuring, and reporting requirements. Direct partnerships with relevant investment organizations should not be ruled out.

- Adopt an “Evergreen” Structure. The fund should be structured such that returns from successful exits are reinvested in additional funding rounds or used to finance other critical NSTC programs, such as incubator support or long-term R&D programs.[105]

- Operate Over a 20-Year Time Horizon. Given long timelines to commercialization for innovation in the microelectronics stack (typically 10 to 20 years), the fund should operate over a 20-year time horizon, as opposed to the 10-year time horizon preferred by conventional venture funds.[106]

- $500 Million Initial Capitalization.[107] A larger fund will allow for additional shots on goal and offer additional flexibility to support scaling via larger Stage B funding rounds.

- Capital Allocation Council. Enabling private sector participation in the fund to provide seasoned technical expertise, evaluative discipline, and the strongest possible diligence. Select VC investors, horizon scanners, and technologists could be convened in an off-the-record, advisory fashion to support NSTC fund managers.

2.3 Augment the NSTC Fund with an Incubator Function

Navigating the microelectronics R&D and funding landscape can be a disorienting experience for innovators. Dozens of federal R&D programs – run seemingly in parallel and with limited connectivity – carry different requirements, grant applications, and government customers, creating hurdles that primarily impact small- and medium-size businesses. Once innovators develop a product, taking their technology to market can be an even more challenging experience. Institutionalized support is needed to increase the odds of successful commercialization.

Objective: Provide a dedicated “help desk” and commercialization support function for microelectronics researchers and innovators to lower barriers to entry.

Method: Establish an “incubator” program linked to the NSTC Investment Fund to offer commercialization support, access to cutting-edge equipment, and mentorship programs for microelectronics innovators. Dedicated commercialization support would increase the odds of success for the NSTC program and startups funded by the investment fund. Such a program should be modeled on approaches taken in recent years by established deep tech investment funds and agile government funders like IQT, DARPA, and the Defense Innovation Unit.[108]

Microelectronics ranks as one of the world’s most R&D-intensive industries: each year, about 19 percent of companies’ profits are immediately re-invested into R&D.[109] For decades, however, public investment in the field has remained relatively flat while industry R&D spending has ballooned.[110] This growing imbalance has shifted the nation’s research priorities from long-term breakthroughs towards short-term incremental improvements. Short-term industry R&D is important to develop and commercialize new process nodes, but the history of the chip industry shows that long-term pathfinding R&D is necessary to develop new technological paradigms.[111]Public R&D spending on microelectronics remains small compared to the roughly $50 billion that the chip industry spends every year on R&D, though the CHIPS & Science Act will go a long way towards addressing the imbalance.[112]

Public R&D spending tends to be a worthwhile investment because it brings additional private dollars with it. This virtuous cycle drives innovation, boosting productivity and GDP growth.[113] According to one estimate, every dollar in additional federal R&D spending raises total R&D spending by $8 by unlocking private investment.[114] But even this cycle is threatened: the U.S. tax code is unfavorable to capital- and R&D-intensive industries like microelectronics, driving chip companies to invest their R&D dollars elsewhere. Additional public funding could not only ensure long-term U.S. leadership in microelectronics, but would also pay significant economic and strategic dividends.

Graphic Source.[115]

3.1 Fuel Compute and Microelectronics R&D for Long-Term Competition

The decline of Moore’s Law has forced the semiconductor industry to spend more and more R&D funding on readying the next several technology nodes for production, rather than funding long-term research into novel and emerging paradigms.[116] Public R&D funding faces two key challenges: first, the Science portion of the CHIPS & Science Act authorizes significant funding increases for early-stage compute and microelectronics research, but this funding has yet to be fully appropriated. Additional public R&D funding for early-stage research is necessary to keep making breakthroughs in materials, devices, and architectures. And second, CHIPS R&D funding – which is focused primarily on applied research, prototyping, and scaling – is set to expire in 2027, leaving programs like the NSTC facing uncertainty and incentivizing a shorter-term focus. Greater assurance of sustained funding would encourage these programs to tackle moonshot goals.

Objective: Building on the groundwork laid by the CHIPS & Science Act, commit to ensuring durable U.S. leadership in compute and microelectronics by a) redoubling public support for basic research in relevant fields as the sector enters a new paradigm and b) providing sustained funding for CHIPS R&D efforts beyond 2027.

Method: Take steps to orient public R&D funding for long-term competition by:

- Fully Funding Significant Increases in Basic Research. Begin by fully funding microelectronics and compute R&D programs at the DOE, DoD, NIST, and NSF to the levels authorized by the Science portion of the CHIPS & Science Act.[117] In addition, Congress should fund the DOE’s Microelectronics Science Research Centers, as authorized by the CHIPS & Science Act.[118]

- Ensuring Sustained Funding for CHIPS R&D Programs. Works towards providing assurance that significant government funding for CHIPS R&D programs, such as the NIST’s Metrology R&D program, will continue beyond 2027. Metrology will play a crucial role in tackling the biggest technical challenges key to unlocking the next era of microelectronics innovation, including thermal management, materials characterization, hardware security, 3D stacking, and heterogeneous integration of exotic devices and materials. Sustained government seed funding will also be necessary to ensure the NSTC successfully achieves its objectives and to de-risk industry investment in the venture.

Developing Comparative Estimates for Microelectronics R&D Spending

Policymakers need reliable estimates for R&D spending in microelectronics and other battleground technologies – both in the United States and the PRC – to guide their investments in a budget-constrained environment. However, updated government estimates for federal microelectronics R&D do not currently exist.[119] This phenomenon also exists for other critical and emerging technologies, including AI, and is largely due to federal budget categories that are delineated by scientific fields, rather than technology categories.

To address this issue in the short term, Congress should commission a study to develop a concrete estimate of federal R&D spending on microelectronics and advanced compute.[120] To ensure the U.S. government is sufficiently organized in the intermediate term, SCSP has recommended the creation of an Office of Global Competition Analysis to conduct research and analysis for policymakers on matters pertaining to techno-economic competition, including comparative R&D spending.[121]

3.2 Crowd-In Industry R&D Funding Through Tax Policy

Federal R&D will not be enough to ensure U.S. leadership in advanced compute and microelectronics: the United States must also become the most attractive place for large chip companies to invest their R&D dollars. The best way to do this is through the tax code. Current U.S. tax code is unfavorable to the semiconductor industry, incentivizing companies to focus on current product lines and spend their R&D dollars outside the United States.[122] Unlike most chip-producing nations, America’s R&D tax credit does not allow firms to immediately expense R&D spending and, because it does not apply to R&D capital equipment, provides little value to the semiconductor industry. Plus, as of 2020, the United States ranked just 24th out of 34 OECD nations in terms of R&D tax credit generosity.[123]

Objective: Make the United States the most attractive nation for large semiconductor companies to invest their R&D dollars by providing competitive R&D incentives.[124]

Method: Rapid action by Congress could incentivize large semiconductor firms to invest their R&D dollars in the United States. Congressional action should be taken to double the Alternative Simplified Credit, an R&D tax credit, from 14 percent to 28 percent for strategic technology sectors.[125] Urgent action is also needed to restore full expensing for equipment purchases, a five year provision under the 2017 Tax Cuts and Jobs Act that has since lapsed.[126] Given that tooling in the semiconductor industry can cost between tens and hundreds of millions of dollars per machine, these moves would significantly increase U.S. competitiveness.[127]

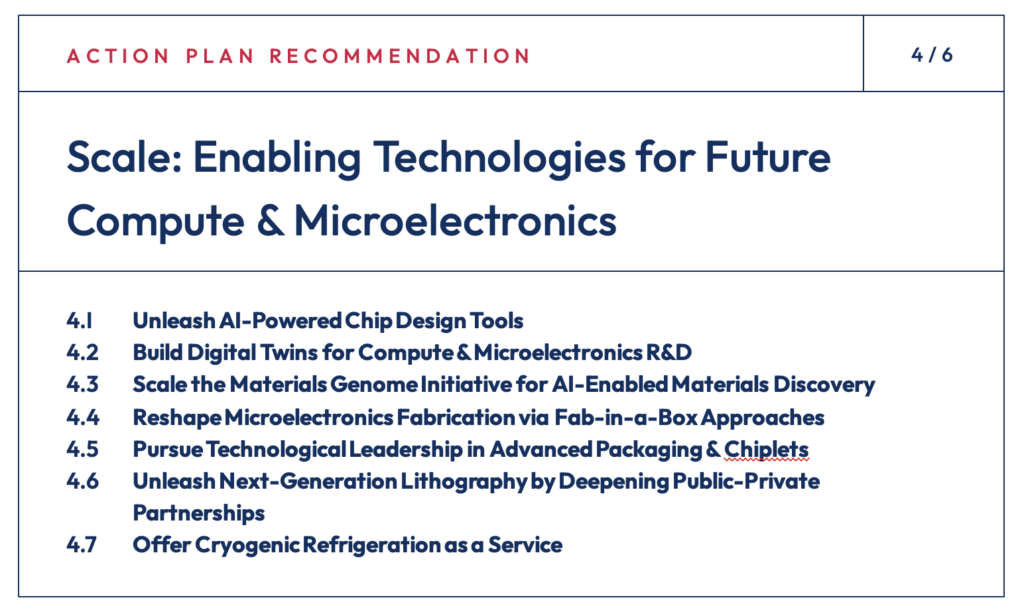

Microelectronics design and fabrication requires a range of sophisticated tools, equipment, and processes. EDA tools, for example, are required to design working electronic circuits on chips that contain billions of transistors. During the fabrication process, each chip goes through over 1,000 steps, many of which require specialized equipment.[128] These enabling technologies are vital to continued compute scaling. In emerging paradigms, enabling technologies are often immature and must be developed in tandem with enabling technologies themselves.

4.1 Unleash AI-Powered Chip Design Tools

GenAI and the more general forms of AI that may emerge have enormous potential to help redesign key aspects of the microelectronics stack. The technology offers a pathway to cut the time it takes to design a chip from months to weeks or even days, while unlocking natural language rather than specialized programming languages as an input.[129] Some of this is not new.[130] However, we are now seeing how GenAI will combine with other specific AI fronts and advanced compute in this decade (e.g., quantum, neuromorphic, and biological computing). If applied to emerging hardware paradigms, like superconductor electronics, these powerful forms of AI tools could unlock significant new breakthroughs.

Objective: Expand and apply the combination of U.S. leadership in chip design tools and GenAI to heterogeneous integration and emerging paradigms, such as photonics, superconductor electronics, and quantum computing.

Method: Each national moonshot program and R&D effort in emerging compute paradigms should pair compute, chip, and manufacturing designers with AI specialists to accelerate prototyping and manufacturing of new capabilities. Additional de-risking through federal R&D programs, in partnership with industry, is also needed to operationalize this technology.

4.2 Build Digital Twins for Compute & Microelectronics R&D

Investment in physics-based simulated environments could help enable a true atoms-to-architectures innovation pipeline while accelerating compute and microelectronics R&D. Advanced physics-based digital twins would enable deep co-design processes that span from materials to large-scale compute systems, allowing for modeling and optimization before designs are prototyped in the physical world.[131] To make this a reality, additional research is needed for multiphysics modeling; simulation of complex large-scale environments, such as a high-yield semiconductor production line; and tightening the feedback loop between theory and experimentation in this area.[132]

Objective: Create digital twins of state-of-the-art microelectronics R&D facilities to enable atoms-to-architectures co-design and dramatically expand access to fabrication tools and prototyping capacity.

Method: NSTC hub data and facilities should be leveraged to create a digital twin/cloud lab for microelectronics research and prototyping, greatly expanding the reach of the program.[133] This effort should be launched under a public-private partnership model, overseen and administered by a third-party industry group yet buttressed by data generated via NSTC research. Access should be available to government, industry, and academic players that meet specified conditions, such as security screening, with upfront costs kept low to enable academia and startups to participate.

4.3 Scale the Materials Genome Initiative for AI-Enabled Materials Discovery

The past 15 years have witnessed a quiet revolution in materials science, with groundbreaking progress made in fields such as magnetic materials, 2D materials, carbon nanotubes, and topological materials.[134] Novel manufacturing processes allow these materials to be grown with atomic precision. Yet these breakthroughs often face a 10 to 20 year commercialization timeline, especially in the microelectronics industry. To address this disconnect, the Materials Genome Initiative (MGI) was launched by the White House in 2011 to “accelerate the discovery, design, development, and deployment of new materials, at a fraction of the cost, by harnessing the power of data and computational tools in concert with experiment.”[135] Yet competition in this space has intensified: the PRC has launched a parallel Materials Genome Engineering project backed by dedicated, large-scale scientific infrastructure for AI-enabled materials discovery and characterization.[136]

The advent of a more general form of AI, coupled with advances in quantum computing that will unlock precision modeling at the molecular level, has made MGI’s ambitious goal of revolutionizing materials science through tightly integrated modeling and experimentation much more achievable by 2030. Deep learning allows for training on massive amounts of data – even a relatively small model can ingest the entire arXiv repository in less than 24 hours.[137] GenAI allows for the autonomous generation of materials candidates, which can then be evaluated by human experts and tested in self-driving “cloud labs.”[138]

Objective: Scale the MGI, capitalizing on America’s lead in GenAI to transform materials science. Integrate MGI more closely with the U.S. microelectronics innovation ecosystem and provide a clear pathway for materials to reach commercialization.

Method: Provide a significant funding increase for MGI to enable the program to capitalize on recent developments in GenAI. In addition, the DOC should create a national center of excellence at the intersection of advanced materials and microelectronics. Such a center could coordinate MGI efforts relevant to semiconductors and would be responsible for convening the private sector, academia, and relevant government players. A national center could be established either as one of the NSTC’s planned technical centers or as a ManufacturingUSA Institute funded under the CHIPS Act.[139]

4.4 Reshape Microelectronics Fabrication via Fab-in-a-Box Approaches

Advances in machine learning, precision additive manufacturing, colloidal chemistry, and bottom-up fabrication for nanoelectronics have opened the door to significant disruptions to the chip manufacturing process. Entire transistors, for example, may conceivably be mass-produced through a growth process – similar to how chemicals are manufactured today – and suspended in an ink. Then, circuits could be created by an additive manufacturing "pen" guided by a specially trained AI model.[140] This ambitious endeavor (and other similar approaches) could unlock microelectronics fabrication in distributed mini-fabs.[141] Significantly reducing the cost of building a fab would also lower barriers to entry for new players, helping to reverse a decades-long trend towards industry consolidation.

Objective: Develop fundamentally new approaches to fabricating microelectronics. Catalyze a 1,000x or greater improvement in cost and/or footprint, as well as flexible manufacturing processes to create custom circuits on-demand.[142]

Method: Launch a national program, based at the NSTC or an alternative R&D agency, tasked with developing and vetting process technologies that challenge fundamental assumptions in today’s microelectronics fabrication process. For example, portable mini-fabs could theoretically print custom circuits on-demand at trailing-edge nodes in minutes rather than the weeks it requires today. While these methods may not produce bleeding-edge chips for AI applications, they promise other exciting opportunities, including new circuit topologies and form factors, natural heterogeneous integration at the microscale, circuits extensible in space and time, and streamlined translation of R&D advances into manufacturing.[143] Alternatively, such a capability could serve as a flexible and adaptable research platform for related microelectronics technologies such as micro-electromechanical systems (MEMS), photonics, and sensors.

4.5 Pursue Technological Leadership in Advanced Packaging & Chiplets

Advanced packaging – the ability to stack chip components on top of one another and connect them in novel ways – enables 3D heterogeneous integration and, as such, is becoming a key factor in microelectronics technology leadership.[144] However, more than 60 percent of packaging and test capacity is located in Taiwan and China, while the United States “lacks any large-scale, commercial state-of-the-art advanced packaging capability.”[145] Today, just three percent of advanced packaging capacity is located in North America.[146]

Advanced packaging enables the combination and stacking of small, modular chips known as chiplets. Each chiplet represents a particular function, which can be combined together to form a complete microelectronic system. While chiplets have been implemented in large vertically integrated companies, creating an open marketplace for chiplets that allows buyers to “mix-and-match” components for specific use cases would unlock innovation and create more opportunities for small companies.[147]

Graphic Source.[148]

Objective: By 2030, position the United States as the driver of global innovation in advanced packaging technologies, including by facilitating creation of an open chiplet ecosystem and sustaining leadership in silicon photonics. Prioritizing innovation in tandem with a planned packaging capacity buildout is more likely to achieve both technological leadership and increasing production capacity than if either of these objectives are pursued alone.[149]

Method: In addition to making significant investments in domestic packaging capacity as part of the CHIPS & Science Act,[150] DOC and other R&D funding agencies should prioritize packaging R&D in areas such as glass substrates, high-density interconnects, and process automation. Applied research and prototyping in silicon photonics should be prioritized as part of the NAPMP and NSTC programs. Additional future support – including tax credits and loans – for domestic packaging, as well as IC substrate capacity, should not be ruled out.[151]

Moves to facilitate the creation of an open chiplet ecosystem include the following:

- NIST should define technical standards for chiplets, in partnership with international industry partners, in a way that enables U.S. firms and entrepreneurs to lead; and

- NSTC should create a testing platform, based on a common set of standards and featuring a shared interface, to evaluate performance claims for chiplets.

4.6 Unleash Next-Generation Lithography by Deepening Public-Private Partnerships

Next-generation lithography techniques and advanced light sources are a technology wildcard which could grant chip companies based in the United States a significant manufacturing edge.[152] But this competition is not taking place in a vacuum: the PRC recently announced that it would build multiple industrial-scale chip factories around particle accelerators in an attempt to circumvent U.S. and allied restrictions on advanced chip tooling.[153]

Objective: Harness the U.S. advantage of national particle accelerators at DOE labs to commercialize next-generation advanced lithography techniques.

Method: The technology and infrastructure developed in U.S. national laboratories for particle accelerators can be used by private sector companies to augment existing lithography tools, turning advanced light sources into an industrial “utility.” The DOE should establish Cooperative Research and Development Agreements (CRADAs) with U.S. companies that can develop prototype tools by way of an open competition, with an end-goal of outfitting multiple research- and industrial-grade facilities.[154] In addition, relevant funding agencies should explore the creation of a “national resource” for advanced light-based (lithography, metrology, and inspection) techniques to foster process innovation in microelectronics.

4.7 Offer Cryogenic Refrigeration as a Service

Today’s quantum computers and most superconductor electronics must be cooled to extremely cold temperatures, just a few degrees from absolute zero. To reach these temperatures, firms must purchase specialized cryogenic refrigeration units that can cost upwards of several million dollars.[155] These high initial costs present a significant barrier to entry for new players seeking to enter the quantum computing and superconductor electronics space.

Objective: Make refrigeration as a service widely available to companies, especially startups, based in the United States and allied nations.

Method: Via the National Quantum Initiative, coordinate the signing of Cooperative Agreements between industry players and relevant U.S. government agencies,[156] including the DOE and NIST.[157] Startups based in the United States and National Technology Industrial Base (NTIB) countries should be eligible to participate.

Microelectronics is a global industry supported by the world’s most complex supply chain: on average, each segment of the semiconductor value chain includes players from 25 nations.[158] Ever since chip shortages rocked the global economy in 2021, semiconductors have found their way onto the agenda for international dialogues. White House-led efforts have resulted in several major deliverables, including bilateral partnerships with Vietnam, India, and Japan, as well as collaboration on the semiconductor supply chain through IPEF and the TTC[159] Building on these efforts, the next opportunity for allied coordination is addressing shared cybersecurity risks stemming from the proliferation of cheap, insecure legacy chips, IoT devices, and other hardware security vulnerabilities.

The intersection of emerging hardware security challenges with China’s rise as the world’s leading producer of chips at legacy nodes has created a new and challenging cybersecurity risk vector.[160] Over the next several years, PRC firms intend to build out nearly as much capacity at these nodes as the rest of the world combined.[161] As noted above, malign actors can plausibly insert vulnerabilities, such as hardware trojans, into systems at the design or fabrication stages. These vulnerabilities are extremely difficult to detect.[162] If an adversary produced lagging-edge chips or chiplets that are compromised, then sold them to critical infrastructure providers, it could enable targeted or large-scale cyberattacks intended either to exfiltrate data or disable or degrade performance of connected devices.[163]

5.1 Boost R&D Collaboration on Secure Microelectronics with Trusted Partners

As cybersecurity risks to the hardware layer proliferate, microelectronics must be designed with security in mind. Innovation in these areas can be supercharged through public-private partnerships and international R&D collaboration with trusted partners.[164] For example, Arm’s Morello project is a public-private partnership between Arm, Stanford University, and Cambridge University, focused on developing a more secure CPU architecture, that has received funding from DARPA and the United Kingdom’s (UK’s)’s Industrial Strategy Challenge Fund.[165] Innovation in hardware security technologies is also a crucial enabler for compute governance mechanisms for AI.[166]

Objective: Create a force multiplier for secure microelectronics R&D by increasing international collaboration.

Method: U.S. R&D funding agencies, including NIST and NSF, should jointly fund R&D collaboration on secure-by-design microelectronics with allied nations such as the UK, Japan, Australia, Taiwan, and South Korea. These areas would also be ideal investments for the Department of State’s International Technology Security and Innovation Fund established under the CHIPS Act.[167] Initial areas for investment could include:[168]

- Trusted execution environments

- AI-enabled verification and validation, including hardware trojan detection

- Physically unclonable functions & secure roots of trust (e.g., for supply chain traceability)

- Tamper-proof packaging

- Secure chiplets

- Side-channel-resistant architectures

- Processes for implementing and enforcing secure-by-design principles

- Privacy-protecting technologies, such as fully homomorphic encryption

The Executive Branch could also create a public-private partnership designed to deepen collaboration in this space via fellowship programs. For example, the DoD and the State Department could partner with R&D funders such as the Semiconductor Research Corporation to launch an international R&D fellowship program focused on secure microelectronics open to scientists from NTIB countries.[169] A DoD-led program could place technical fellows at government research programs (such as DoD’s Microelectronics Commons), university research centers,[170] and major industry players.

5.2 Increase International Collaboration on Legacy Chips

The PRC is subsidizing massive capacity buildouts for legacy chips,[171] which are utilized for a variety of general purpose microcontrollers, including IoT devices and 95 percent of automotive chips.[172] Major democratic market economies including the European Union (EU), Japan, South Korea, and the United States should join forces to insulate their markets, guard against security risks, and avoid deepening reliance on heavily subsidized PRC lagging-edge chips.

Objective: Create a level playing field for chipmakers in the United States and allied and partner countries by adopting a ‘market demand pooling’ strategy for lagging-edge microelectronics.[173]

Method: Elevate policy coordination on legacy chip production in fora such as bilateral dialogues with Germany, Japan, South Korea, Taiwan, and the TTC; trilateral trade meetings between the United States, the EU, and Japan; and other dialogues with allies and partners.[174] As a first step, a group such as the United States, the EU, Japan, and South Korea should jointly should assess the economic andand national security implications of China’s massive capacity buildout for trailing- and lagging-edge chips, including hardware security issues stemming from their likely deployment throughout critical infrastructure sectors in democratic market economies.[175] The United States and its allies and partners should also consider policy measures such as common or coordinated security protocols – developed with input from appropriate industry bodies – and coordinated use of trade tools, including tariffs.

Graphic Source.[176]

5.3 Develop Labeling and Certification Requirements for Microelectronics Used in U.S. and Allied Critical Infrastructure Sectors

Many firms servicing critical infrastructure sectors possess limited visibility into their own supply chains and may be unaware of the origins of electronic components in their systems.[177] Restrictions on DoD purchases of chips produced by countries of concern were included as part of the 2023 National Defense Authorization Act (NDAA), but these restrictions contain considerable loopholes, do not apply to critical infrastructure sectors, and do not go into effect until 2027.[178] Additional mechanisms are needed to assess and manage risk to these sectors from microelectronics produced in the PRC.

Objective: Assess and mitigate risk to critical infrastructure – in both the United States and among allies and partners – stemming from microelectronics and other electronic components produced in countries of concern.

Method: Steps that could be taken through either Congressional and/or Executive action include:

- Increase Transparency by Requiring a Hardware Bill of Materials (HBOM):[179] Require firms servicing U.S. government customers and critical infrastructure providers to disclose country-of-origin and other information on hardware components via an HBOM. This measure would be a critical first step toward providing much-needed supply chain transparency[180] and would allow for cybersecurity vulnerabilities at the hardware or firmware level to be resolved more rapidly.[181] Building on its recently released HBOM Framework for Supply Chain Risk Management,[182] the Cybersecurity and Infrastructure Security Agency (CISA), in collaboration with NIST, should be directed to develop guidelines for HBOM disclosures. The State Department and NIST should engage with U.S. allies and partners on this requirement as part of a diplomatic initiative on cybersecurity at the hardware level.

- Assess Risk to Critical Infrastructure by Flagging High-Risk Chips: The DOC, with support from relevant sector risk management agencies, should create a three-tier certification system to classify microelectronics destined for critical infrastructure sectors as high-risk, medium-risk, and low-risk. DoD’s work on secure supply chain methodologies – such as the Trusted Foundry and Microelectronics Quantitative Assurance models – should be leveraged where feasible to ensure design security and testing and validation checks.[183] The 2019 Executive Order on Securing the Information and Communications Technology and Services Supply Chain could also be used to restrict purchases from high-risk suppliers.[184]

5.4 Promote Robust Critical Infrastructure Security Standards with Allies and Partners

Setting security standards is an essential move to promote hardware security for critical infrastructure, and this effort must be done with allies and partners to be effective. Attention should be paid to the entire hardware stack, from IoT modules to the chips which power these devices. Passed in 2020, the IoT Cybersecurity Act was the first piece of U.S. legislation to address the cybersecurity of IoT devices, but more work remains to be done to address critical infrastructure or secure microelectronics at home and abroad.[185]

Objective: Expand security standards for IoT cybersecurity to critical infrastructure sectors, including a focus on hardware and firmware.

Method: Take both domestic and diplomatic action, including:

- Domestic: Fully implement the IoT Cybersecurity Act of 2020 by releasing cybersecurity standards for critical infrastructure sectors. NIST has addressed cybersecurity guidance aspects of the IoT Cybersecurity Act,[186] but is also required to develop sector-specific standards in coordination with the CISA, sector risk management agencies,[187] and industry.[188] Future efforts to develop these standards should include a robust line of effort on hardware security.

- International: Developing IoT standards for critical infrastructure would be much more effective if done in consultation with allies and partners. The State Department, in consultation with NIST, should engage with allies and partners to strengthen security standards for critical infrastructure. In addition, hardware cybersecurity should be prioritized as a line of effort at international dialogues with allies and partners such as Taiwan, the EU, South Korea, and Japan.

Talent is a key enabler that underpins the nation’s competitiveness in any international technology battleground. Even as human-machine teaming transforms the way science is done, human intuition, communication, and abstract reasoning will always be at the center of how America innovates. The United States must set the path today to develop, attract, and retain a world-class workforce across the various disciplines that drive microelectronics innovation.

Currently, the United States faces a significant shortage of technicians and engineers needed to staff fabs – some estimates place this shortage at approximately 90,000 workers.[189] Several academic-industry consortia,[190] led by universities like Purdue, Arizona State University, and the Ohio State University, have launched programs to provide training from the Associates’ to PhD levels.[191] To scale emerging paradigms and promote disruptive innovation, however, the nation must focus beyond staffing fab positions to training future research talent.

6.1 Attract International Microelectronics Talent

Roughly 40 percent of America’s high-skill microelectronics workers were born abroad.[192] Yet outdated high-skill immigration policies force many of these microelectronics workers to return to their home countries. With impending workforce shortages in both research and fab operation, creating clear pathways for microelectronics talent to study and work in the United States must be treated as a national imperative.

Objective: Create clear pathways to attract and retain the world’s top microelectronics talent by improving high-skill immigration.

Method: Congress should take steps to bolster the pipelines for international microelectronics talent, including:

- Exempt PhD holders in relevant fields from the current H-1B visa cap;

- Grant green cards to STEM PhD students graduating from accredited U.S. universities who intend to work in the microelectronics industry;

- Develop an “innovator” visa category, similar to the UK’s and Australia’s Global Talent Visa programs, for high-skilled immigrants working in the chip industry.[193]

6.2 Nurture Communities of Engineering Practice in Emerging Paradigms

Emerging compute paradigms are characterized by tight-knit research communities with specialized knowledge and skills. To this point, however, these communities have received minimal support from U.S. policymakers. Targeted intervention could grow the reach of these communities and expand their ranks.

Objective: Provide resources and support for communities of engineering practice in emerging paradigms.

Method: The DOC should take the following actions:

- Convene and support roadmapping efforts for emerging paradigms at NSTC facilities;

- Commission new textbooks and course materials for novel paradigms like superconductor electronics;[194]

- Develop an “atlas” of job descriptions and necessary skills for the chip industry, linked to training programs and courses that students should take;

- In coordination with the Department of State, launch a “Fulbright for NSTC” program to bring skilled researchers from trusted institutions to collaborate on national moonshot programs.

6.3 Scale the “Custom Silicon” Effort for College Student Experiments

During the early 1980s, CMOS emerged as the leading paradigm for silicon microelectronics thanks to new opportunities for students to learn and experiment with building their own chips.[195] DARPA’s MOSIS program, launched in 1981, enabled students to design chips and get them shipped for free.[196] This program, in turn, catalyzed breakthroughs in design tools that unleashed U.S. innovation. Providing similar opportunities today could catalyze a new generation of future semiconductor researchers and engineers and help spark new breakthroughs.

Objective: Create new opportunities for students to experiment with cutting-edge microelectronics by scaling the custom silicon movement.

Method: U.S. R&D funding agencies, including NSF, DOC, and DARPA, should scale public-private partnerships that provide students with as much hands-on experience designing and building their own chips as possible. For example, Google has teamed up with Global Foundries, Skywater, and startup Efabless on a Custom Silicon effort that allows anyone to design their own chips.[197] These tools should be supercharged with generative AI so that natural language can be used as an input.

Appendix A

Additional Elements of Success

Continued leadership in advanced compute and microelectronics is not assured. Success depends on many factors and efforts, some of which are already ongoing and lie out of the scope of this action plan. Additional elements of success include:

- The CHIPS & Science Act must restore some advanced semiconductor fabrication back to the United States. The National Security Commission on Artificial Intelligence called for maintaining multiple sources of cutting-edge microelectronics fabrication inside the United States to restore leading-edge chip fabrication on American soil.[198] This policy has remained largely constant, with Commerce Secretary Gina Raimondo calling earlier this year for at least two clusters of leading-edge logic in the United States.[199] By mid-decade, the world’s most advanced process nodes may once again be fabricated on American soil.

- The NSTC and DoD’s Microelectronics Commons program should combine to establish meaningful prototyping capacity in the United States. These programs can successfully unlock prototyping capacity for both specialty wafer runs and industry standard 300mm wafer runs, creating additional opportunities for startups and researchers.

- Government intervention and current U.S. leadership in chip design can propel U.S. firms to leadership in chip specialization. U.S. firms enjoy an overwhelming lead in chip design. As the chip industry increasingly shifts towards building specialized accelerators for key applications like AI, the combination of market incentives and federal R&D spending will help to keep U.S. firms at the forefront.

- Ensuring leadership in edge applications is critical. Chips for edge applications, like robotics, IoT modules, cars, and 5G base stations, require extremely low-power designs and mix digital and analog components in the same package. The PRC’s push for dominance in these sectors will extend to the underlying microelectronics. Leadership cannot be left to chance.

- Protect actions in compute and microelectronics are warranted, but running faster is also necessary for sustained U.S. advantage. The United States faces a determined competitor that brings substantial resources and sophisticated espionage and industrial capabilities to the table. As such, the PRC will likely make gains in key microelectronics verticals. Technology protections and common sense guardrails like research security policies are essential, and must be supported with sufficient resources and tools to enable robust implementation,[200] but these guardrails are no substitute for an acceleration of innovation by the United States and its allies and partners.

Endnotes

[1] See, e.g., Tristan Holtam, As Chipmakers Assess “Where” to Build New Fabs, the “How” of Semiconductor Innovation Must Remain a Priority, Applied Materials (2023).

[2] Timothy F. Bresnahan & Manuel Trajtenberg, General Purpose Technologies: "Engines of Growth?", National Bureau of Economic Research (1992).

[3] David Grossman, How Do NASA's Apollo Computers Stack Up to an iPhone?, Popular Mechanics (2017).

[4] John Shalf, The Future of Computing Beyond Moore’s Law, Philosophical Transactions of the Royal Society (2020); James R. Powell, The Quantum Limit to Moore's Law, Proceedings of the IEEE (2008).

[5] As historian Chris Miller notes, “most of the world’s GDP is produced with devices that rely on semiconductors.” Chris Miller, Chip War: The Fight for the World’s Most Critical Technology, Simon & Schuster at 23 (2022).

[6] Neil C. Thompson, et al., The Importance of (Exponentially More) Computing Power, arXiv (2022).

[7] Advanced compute can be defined as “computer systems where processing power, memory, data storage and network are assembled at scale to tackle computational tasks beyond the capabilities of everyday computers.” Independent Review of The Future of Compute: Final Report and Recommendations, UK Department for Science, Innovation & Technology (2023).

[8] Nerissa Draeger, Happy 150th Birthday to the Periodic Table, Lam Research (2019); Chapter 2: Energy Efficiency, MAPT: Microelectronics and Advanced Packaging Technologies Roadmap, Semiconductor Research Corporation at 47 (2023).

[9] See Decadal Plan for Semiconductors: Full Report, Semiconductor Research Corporation at 6 (2020); Catherine D. Schuman, et al., Opportunities for Neuromorphic Computing Algorithms and Applications, Nature Computational Science at 16 (2022). In a post-Moore's Law world, co-design is necessary to drive innovation across each layer of the stack simultaneously. See Cherry Murray, et al., Basic Research Needs for Microelectronics, U.S. Department of Energy at 8 (2018).

[10] Several large-scale studies and initiatives exist in this space. IEEE’s Rebooting Computing Initiative formed in 2013 in response to concerns that transistor scaling was nearing its limits. It manages the authoritative International Roadmap for Devices & Systems. IEEE Rebooting Computing Task Force, IEEE (last accessed 2023). A 2017 White House report authored by the President’s Council of Advisors on Science & Technology called for a “leapfrog” strategy to maintain U.S. competitiveness in compute and microelectronics, outlining several moonshots that the nation could pursue. Report to the President: Ensuring Long-Term U.S. Leadership in Semiconductors, President’s Council of Advisors on Science and Technology (2017). The Semiconductor Research Corporation released an authoritative Decadal Plan in 2020 outlining five “seismic shifts” that the semiconductor industry must navigate, alongside five “grand goals” that aim to accomplish this. Decadal Plan for Semiconductors: Full Report, Semiconductor Research Corporation (2020). DARPA’s Electronics Resurgence Initiative and Electronics Resurgence Initiative 2.0 have organized an ecosystem around 3D heterogeneous integration while tackling key challenges like hardware security. Electronics Resurgence Initiative 2.0, Defense Advanced Research Projects Agency (last accessed 2023). A 2022 PCAST report highlighted ways that the CHIPS Act could be used to strengthen the U.S. innovation ecosystem for microelectronics. Report to the President: Revitalizing the U.S. Semiconductor Ecosystem, President’s Council of Advisors on Science & Technology (2022).

[11] See Harnessing the New Geometry of Innovation, Special Competitive Studies Project at 30-32 (2022); Michael E. Porter, What Is Strategy?, Harvard Business Review (1996).

[12] Harnessing the New Geometry of Innovation, Special Competitive Studies Project at 30 (2022).